Banking Business Model PowerPoint and Google Slides

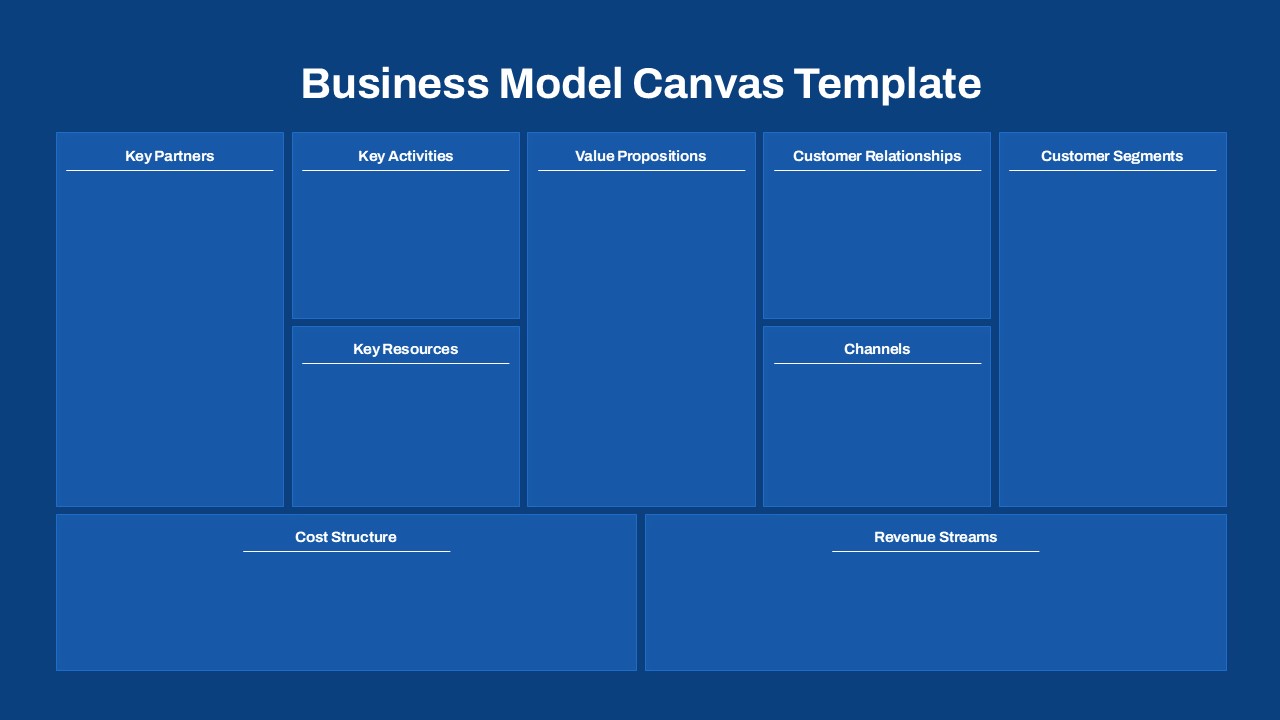

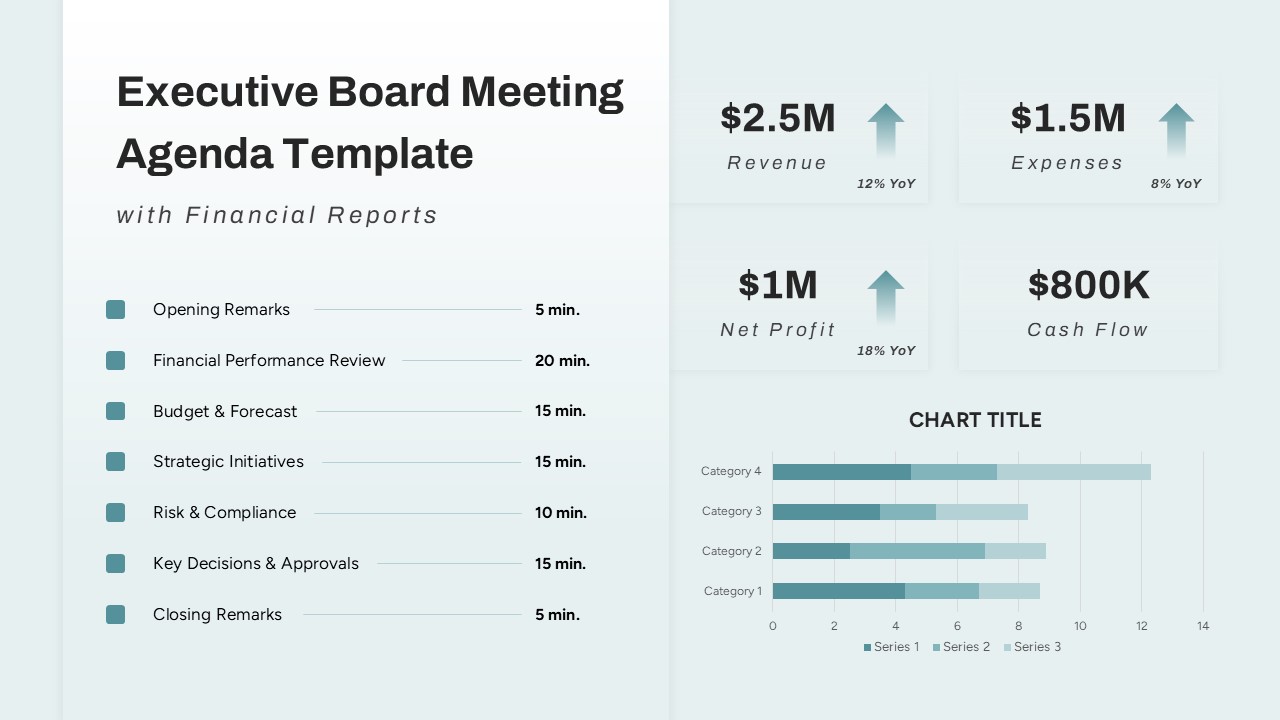

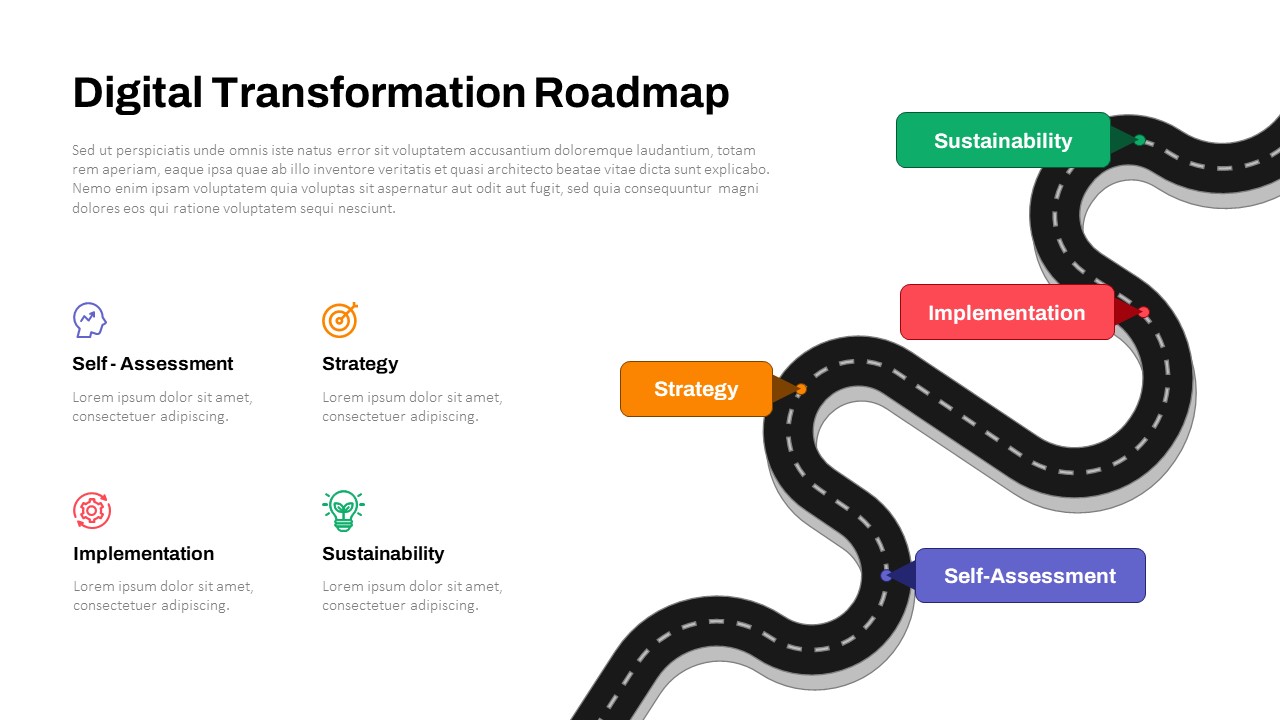

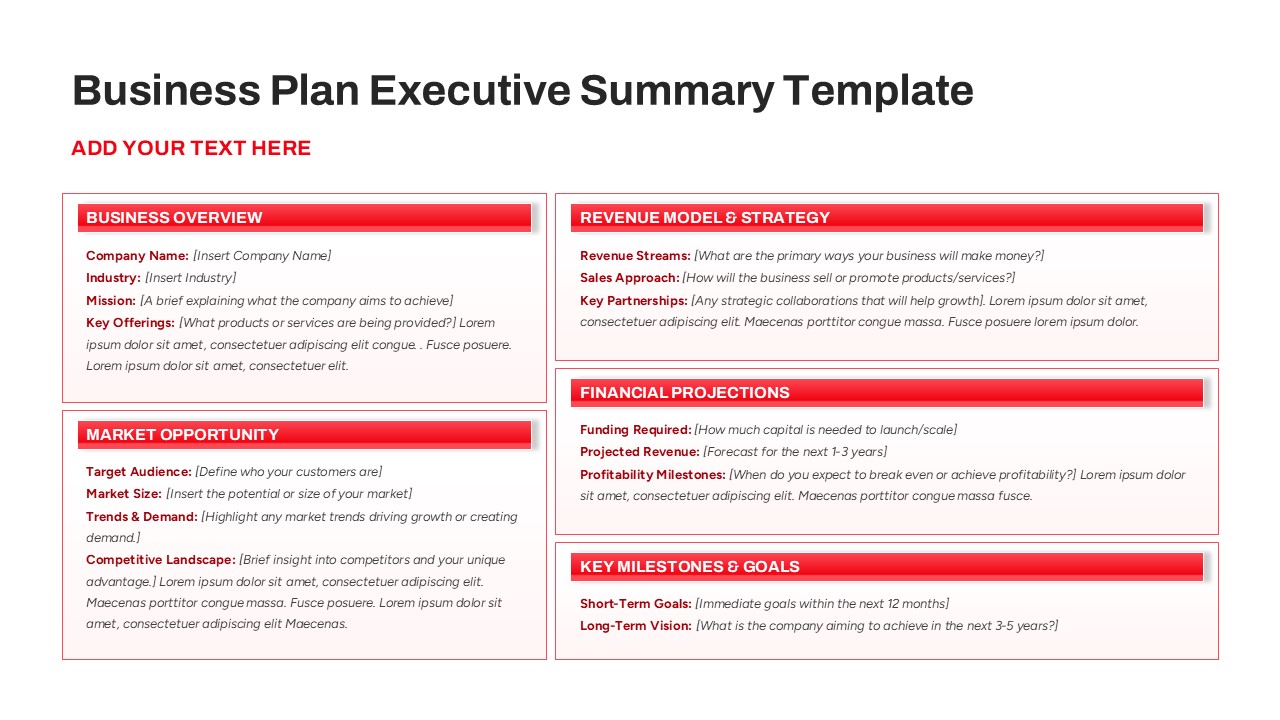

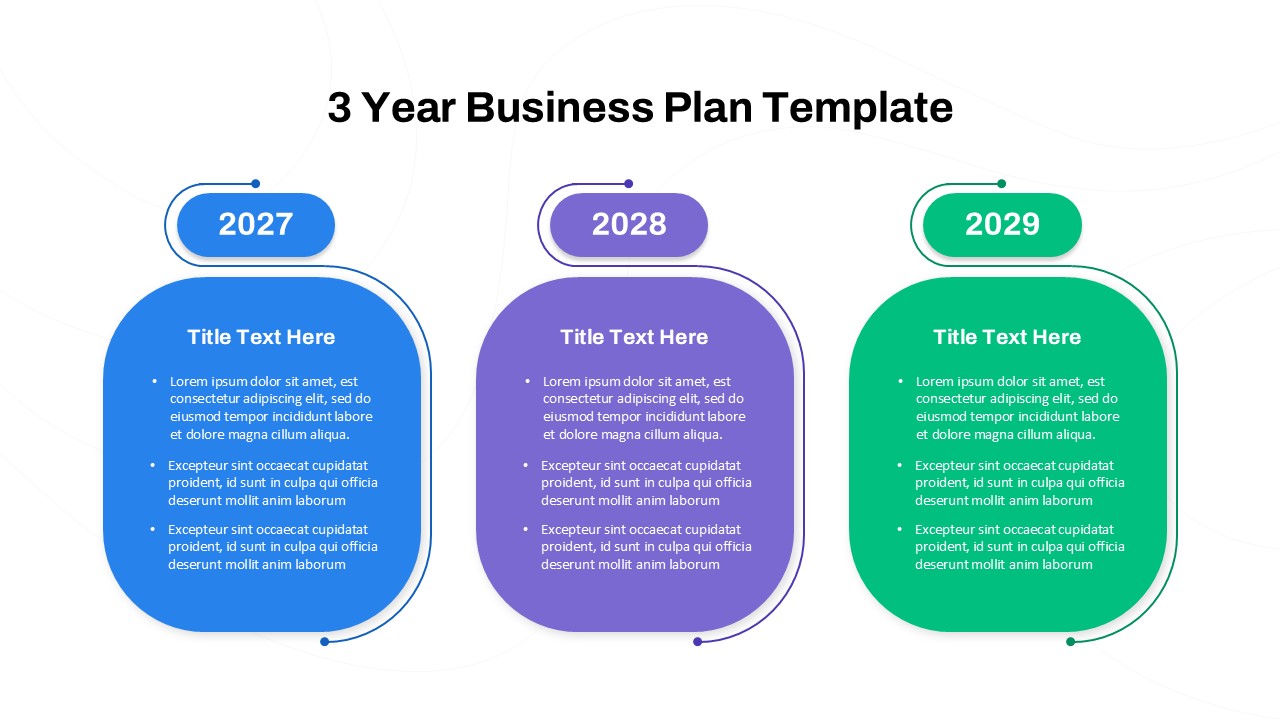

Present a comprehensive overview of modern banking strategies with this Banking Business Model PowerPoint Template, tailored for professionals in finance, consulting, or academic settings. This structured, easy-to-understand slide breaks down the key components of a banking business model—enabling users to explain complex financial frameworks in a clear, visual manner.

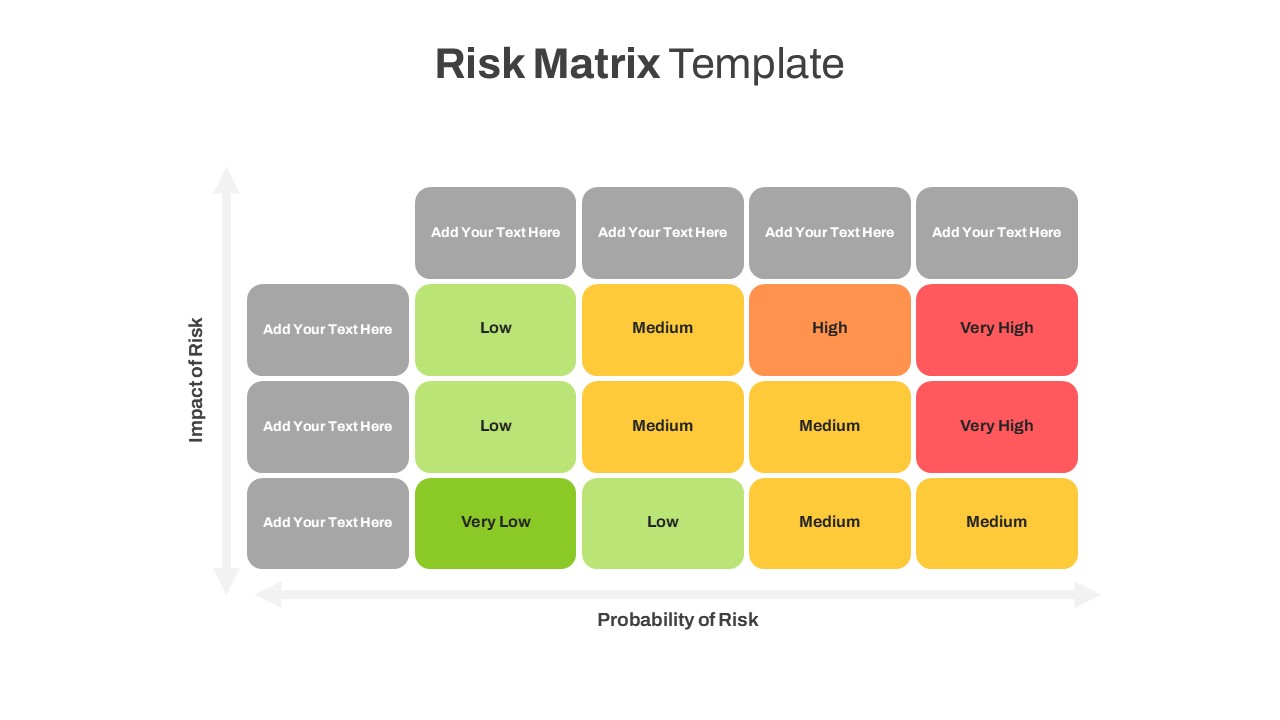

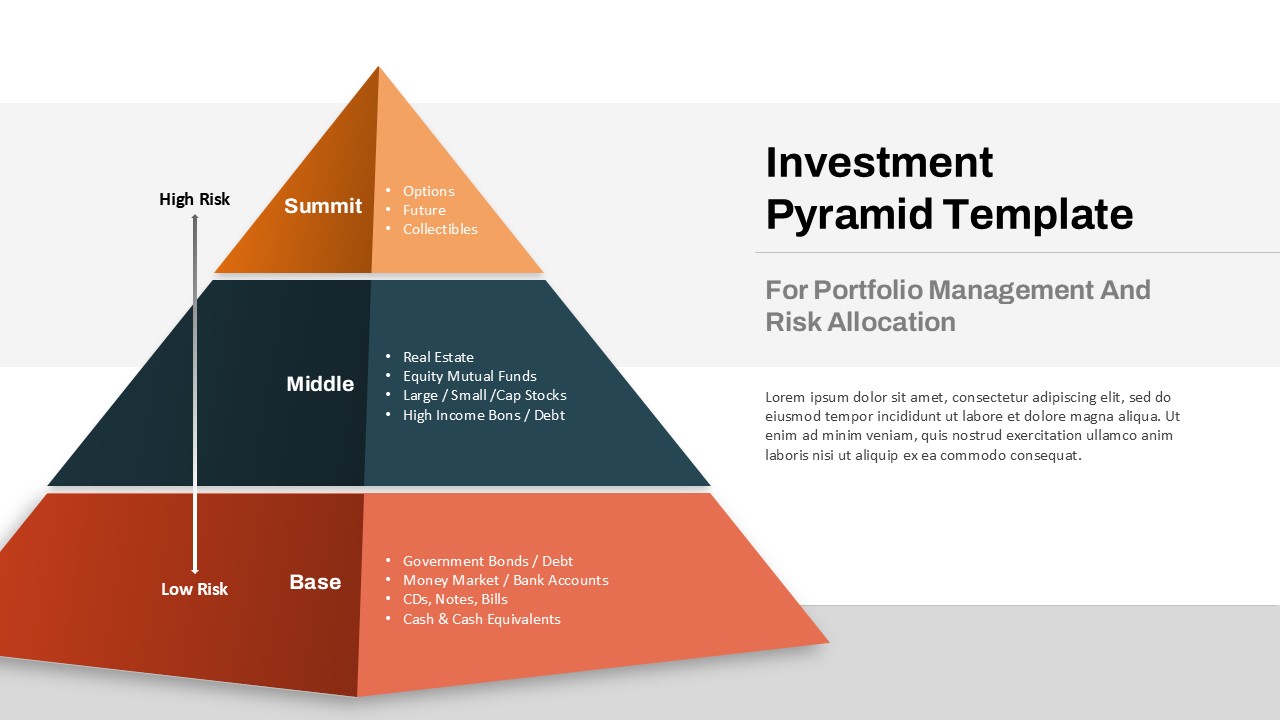

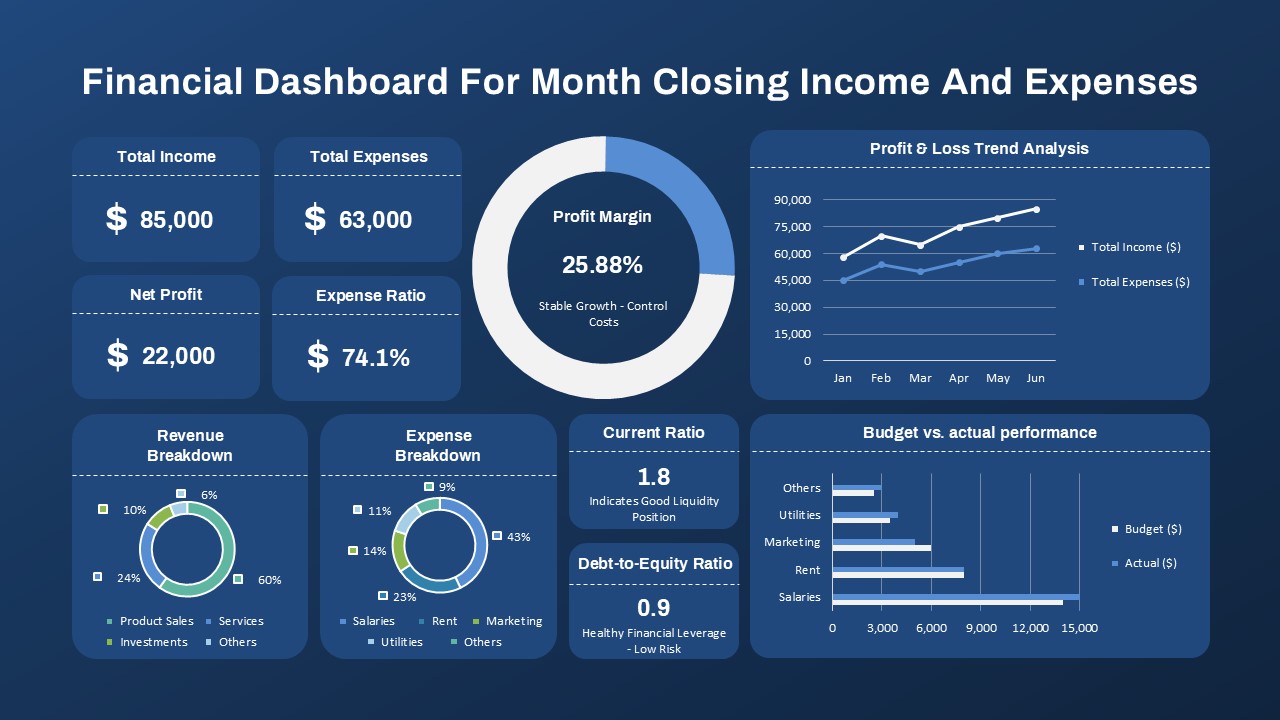

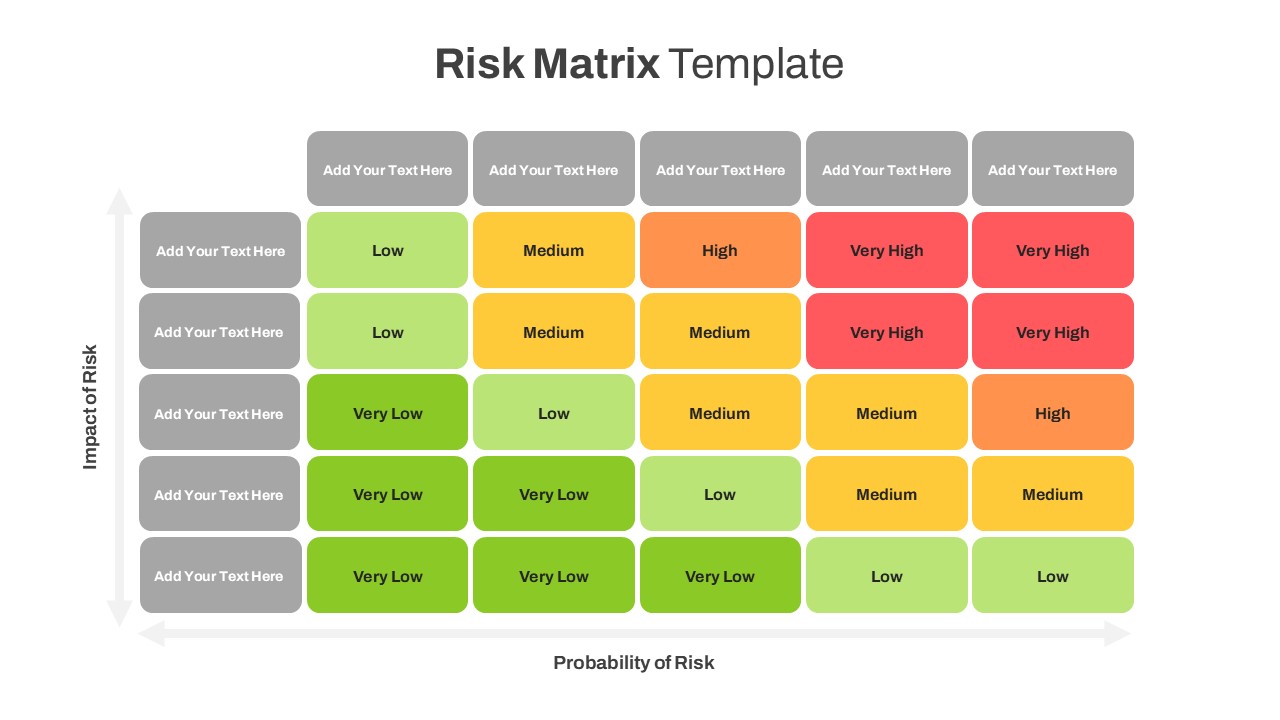

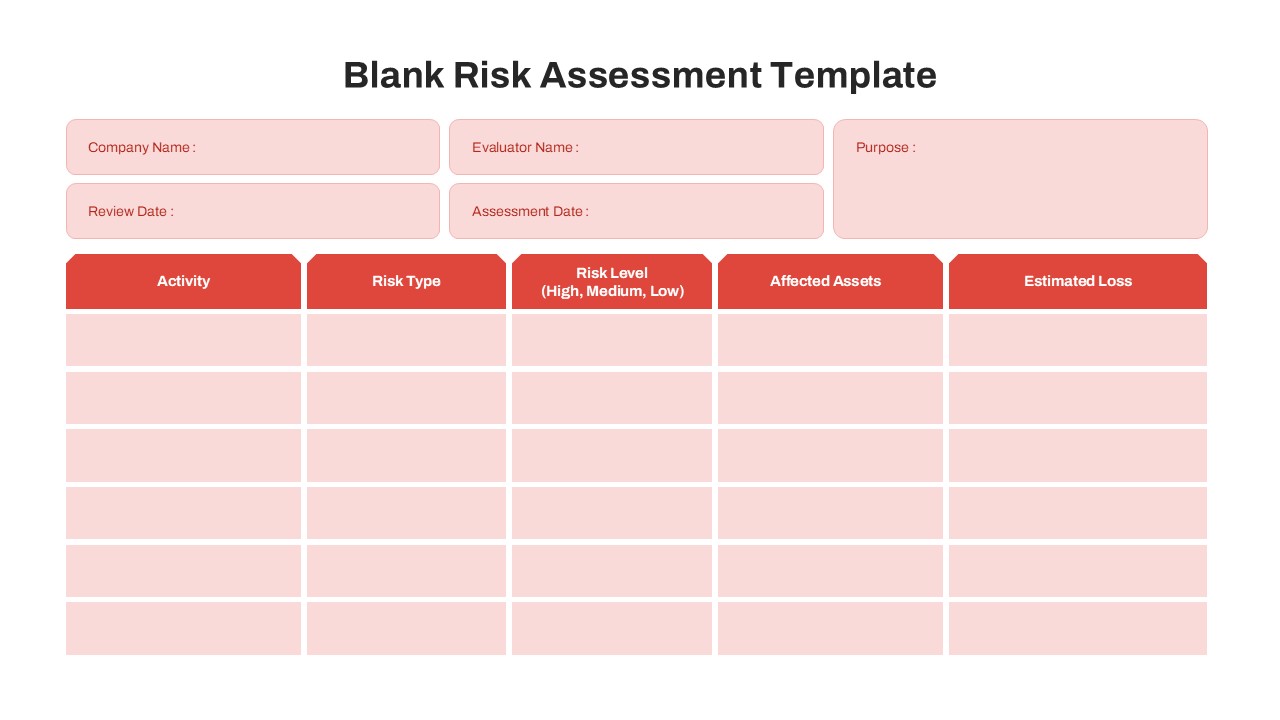

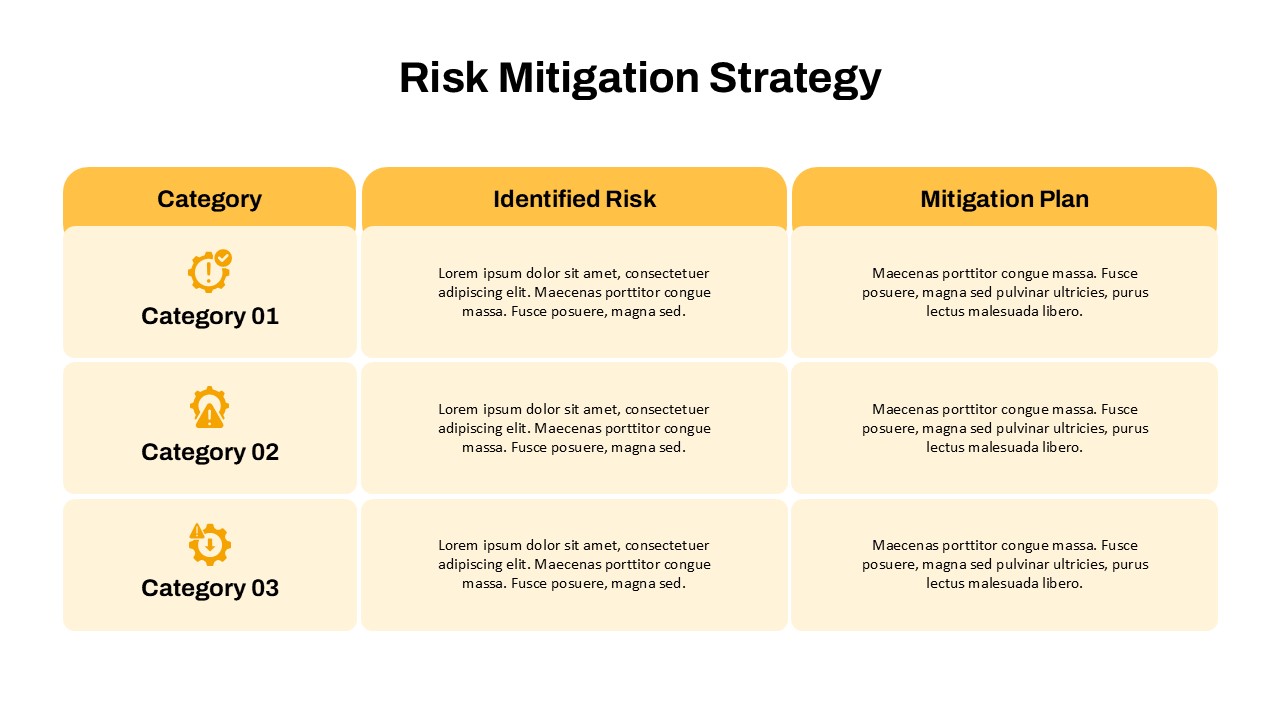

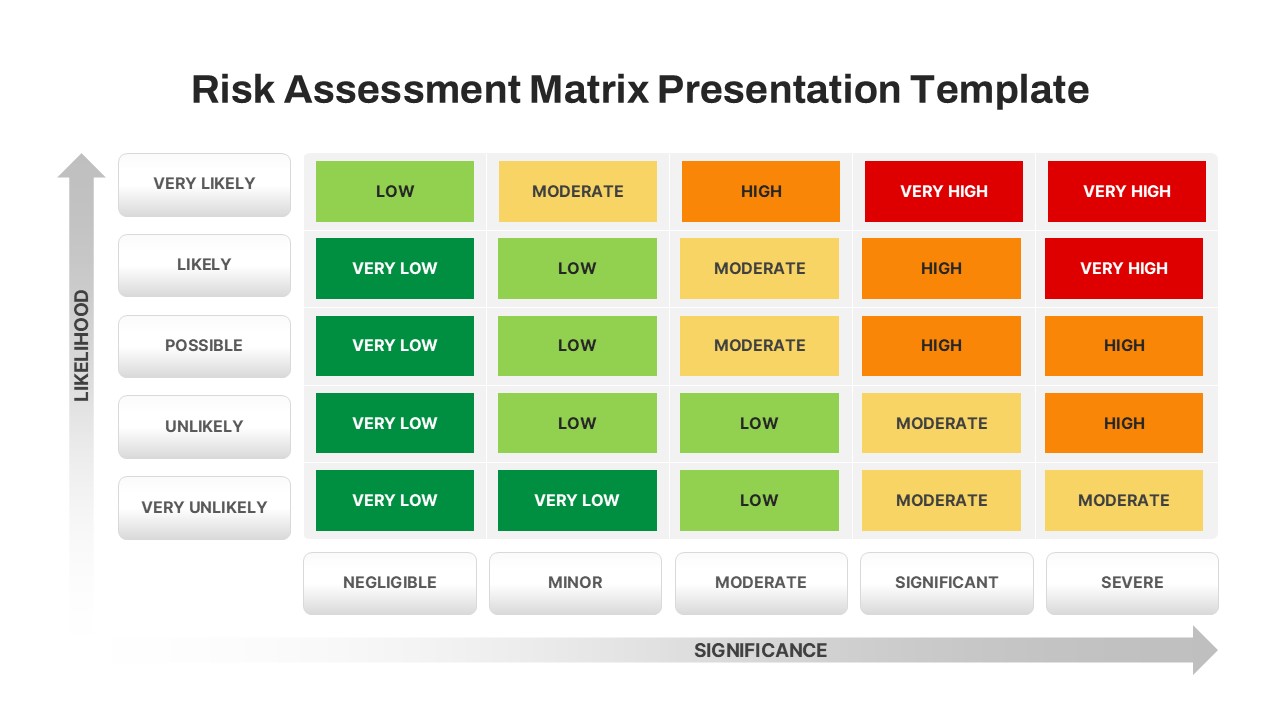

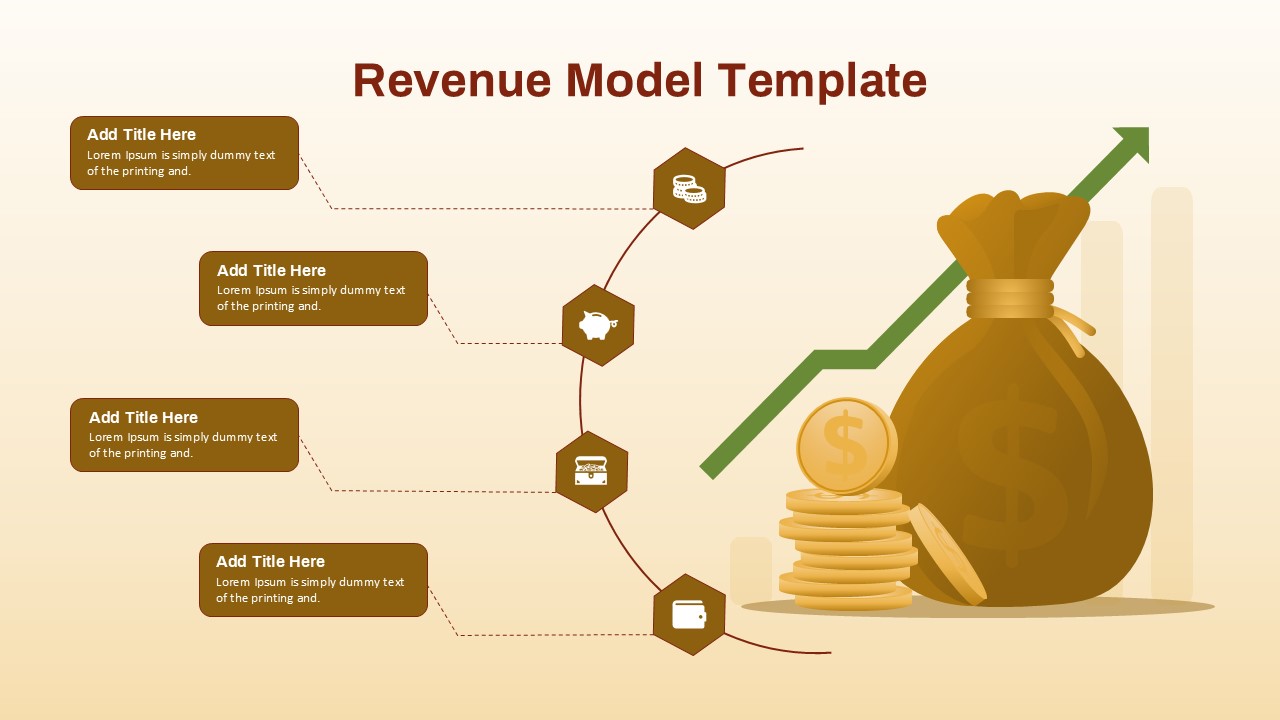

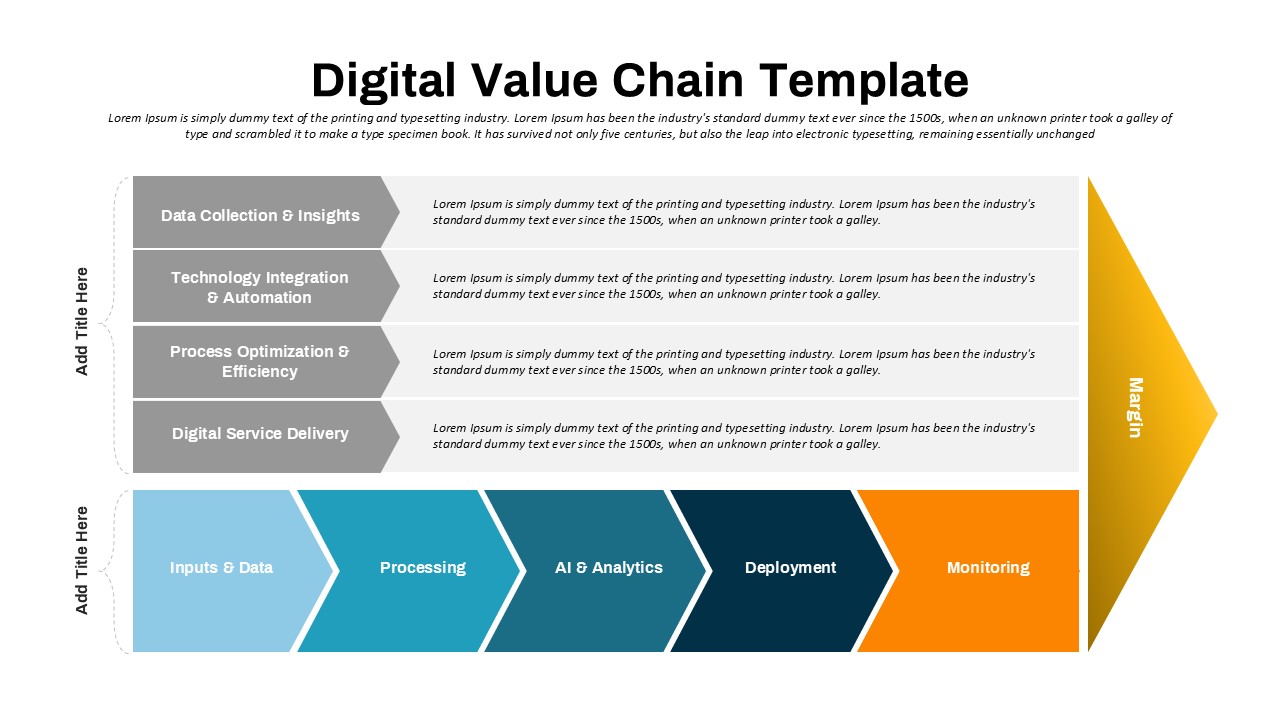

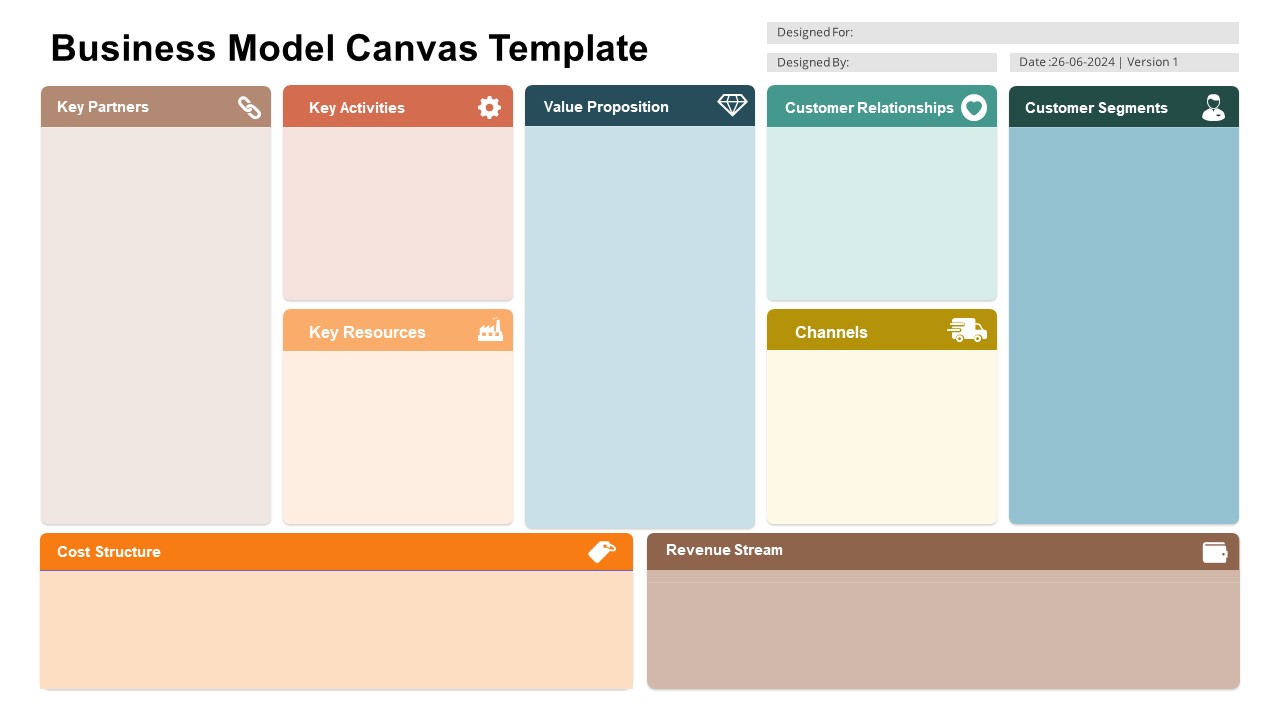

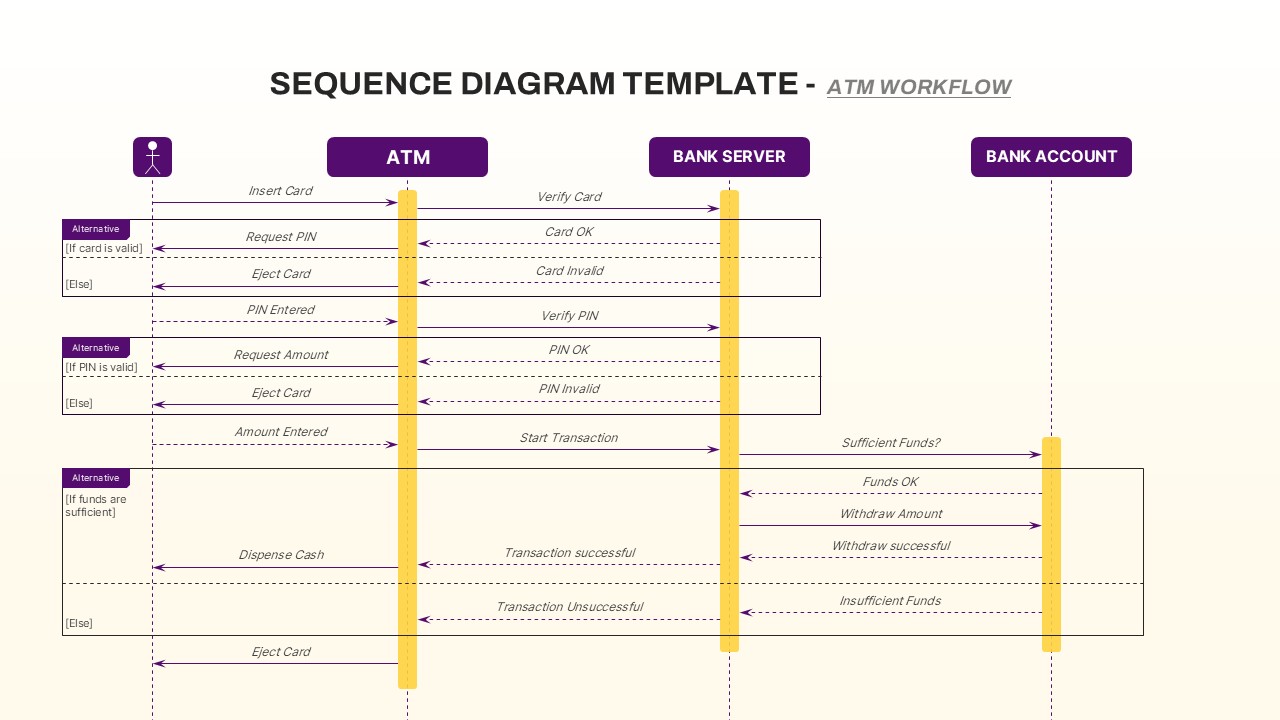

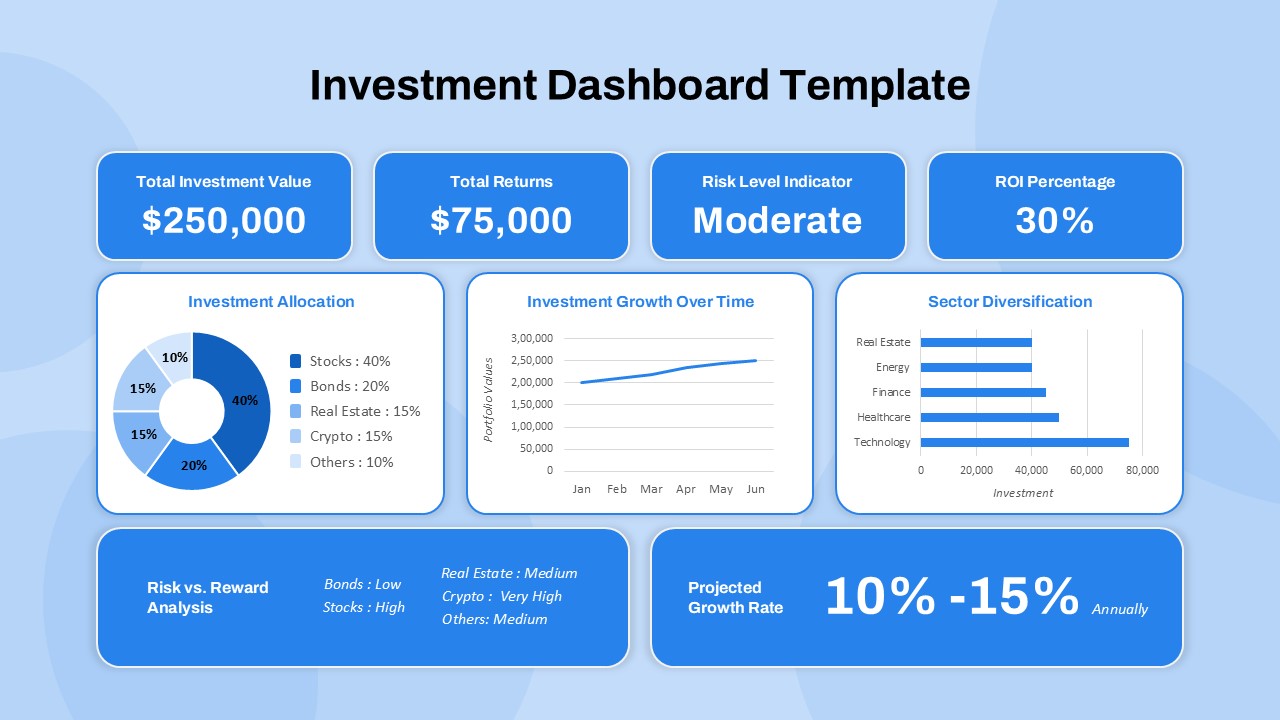

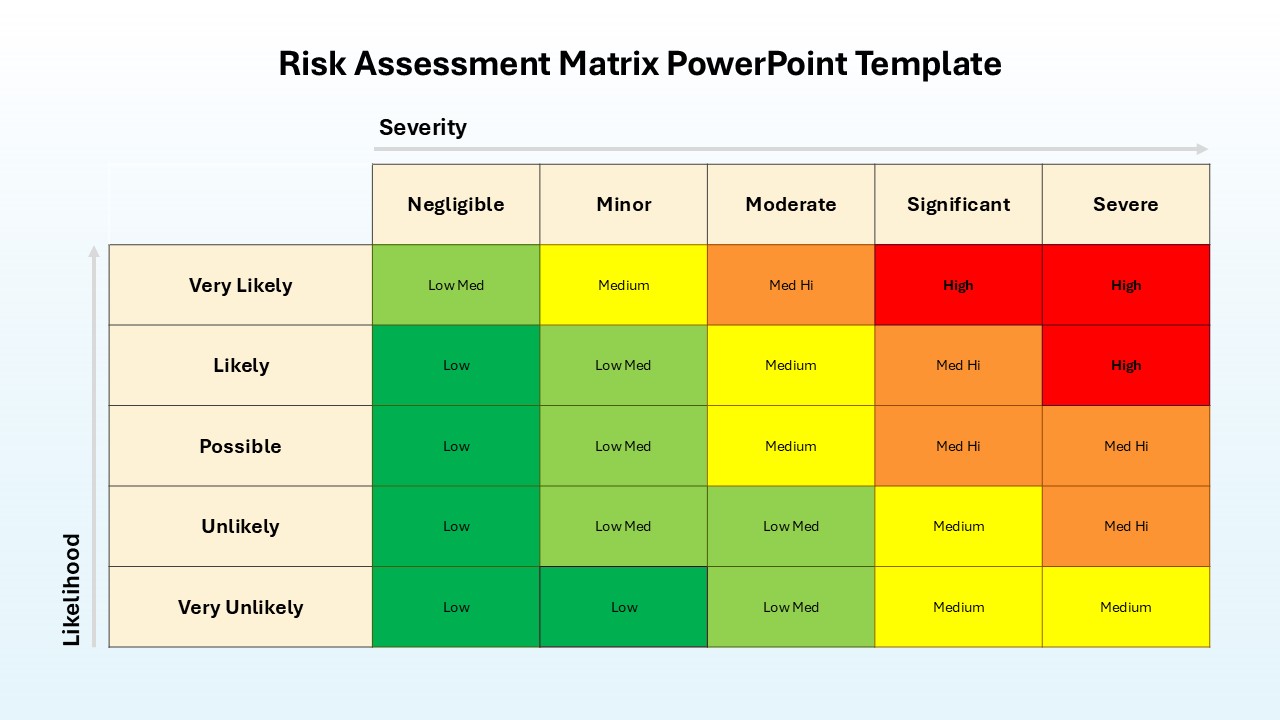

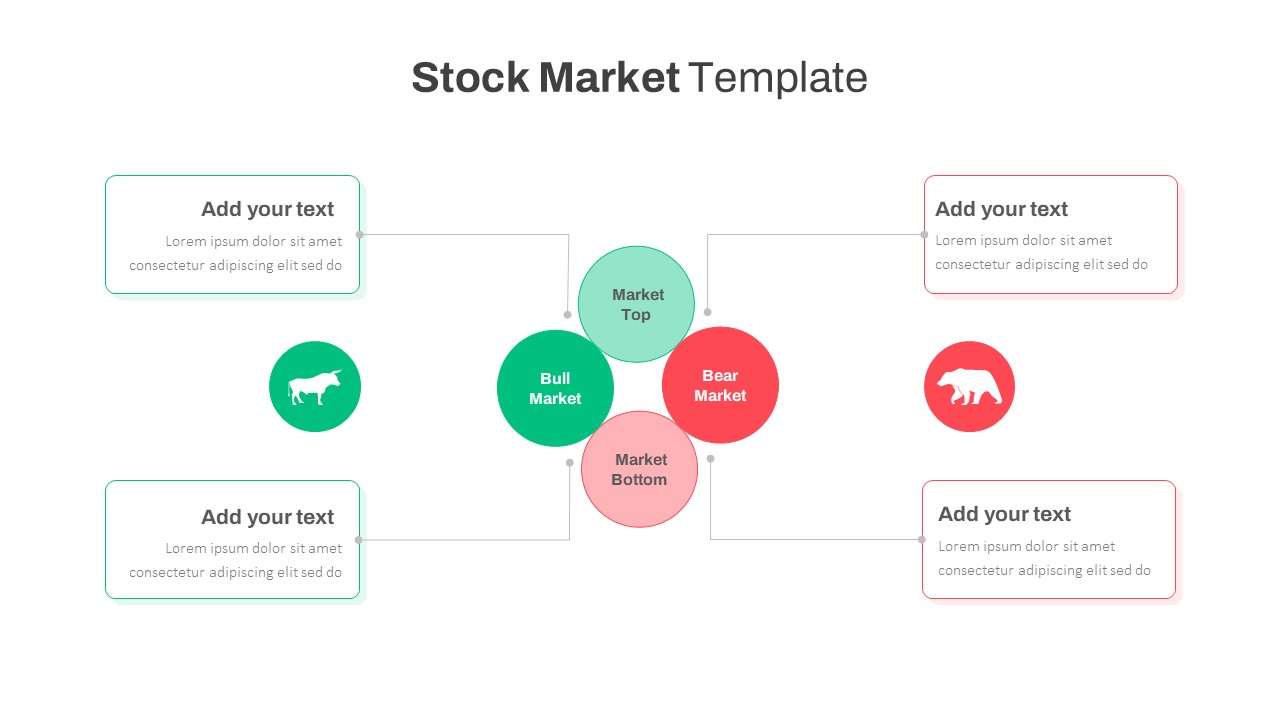

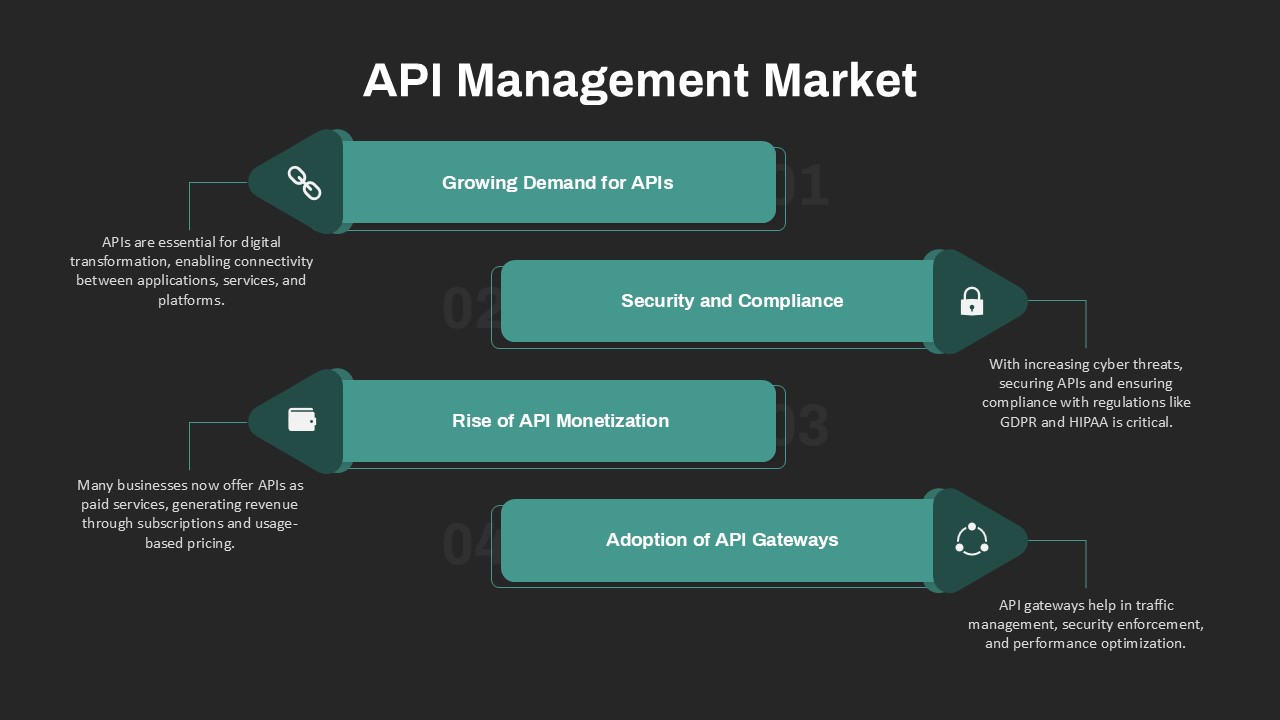

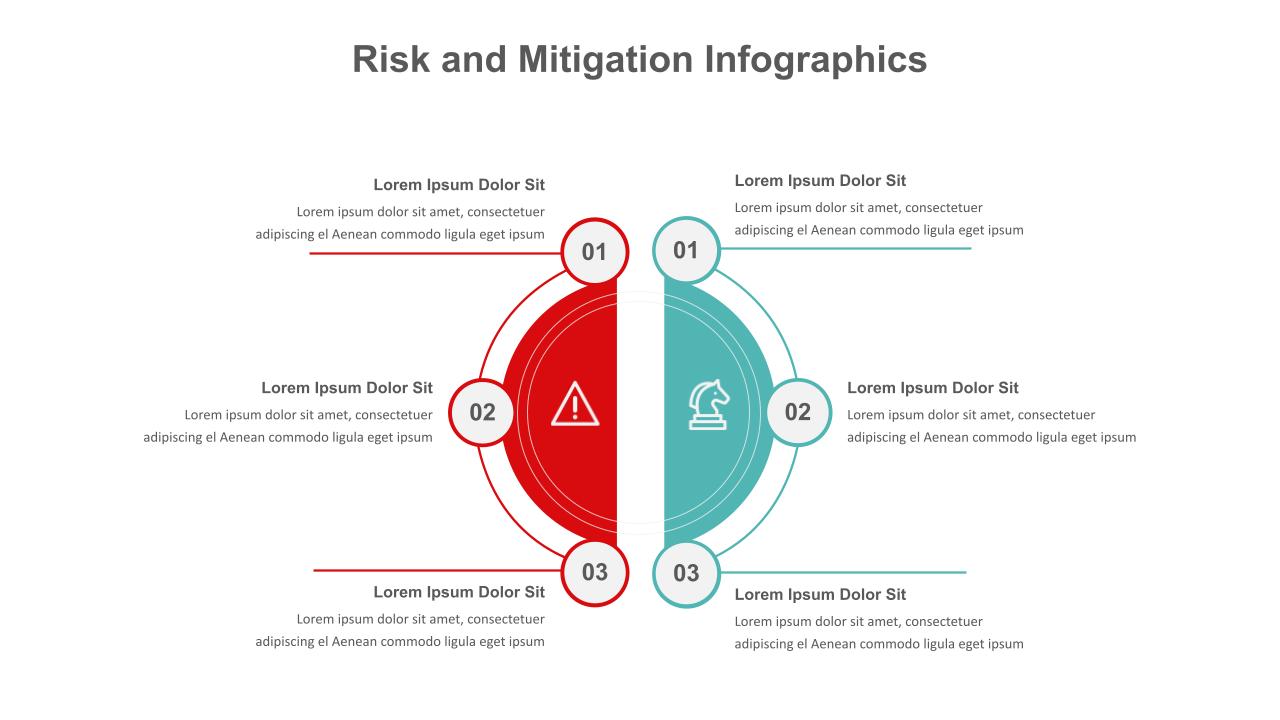

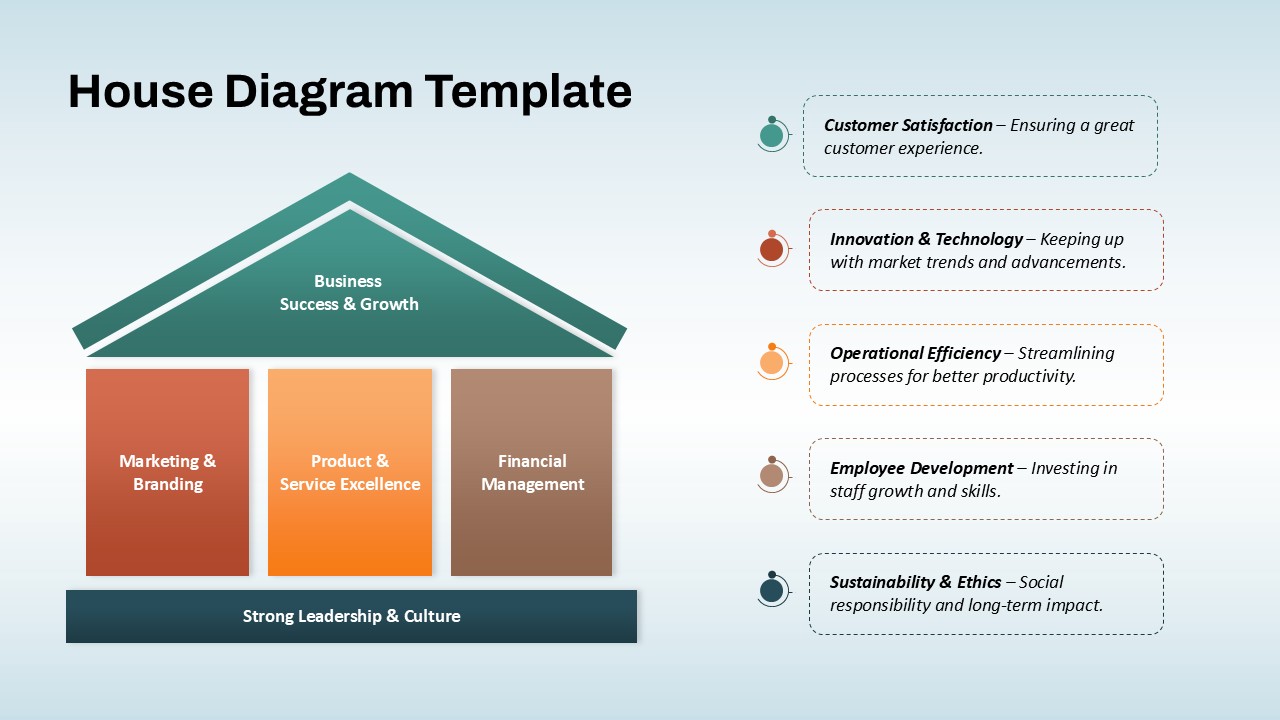

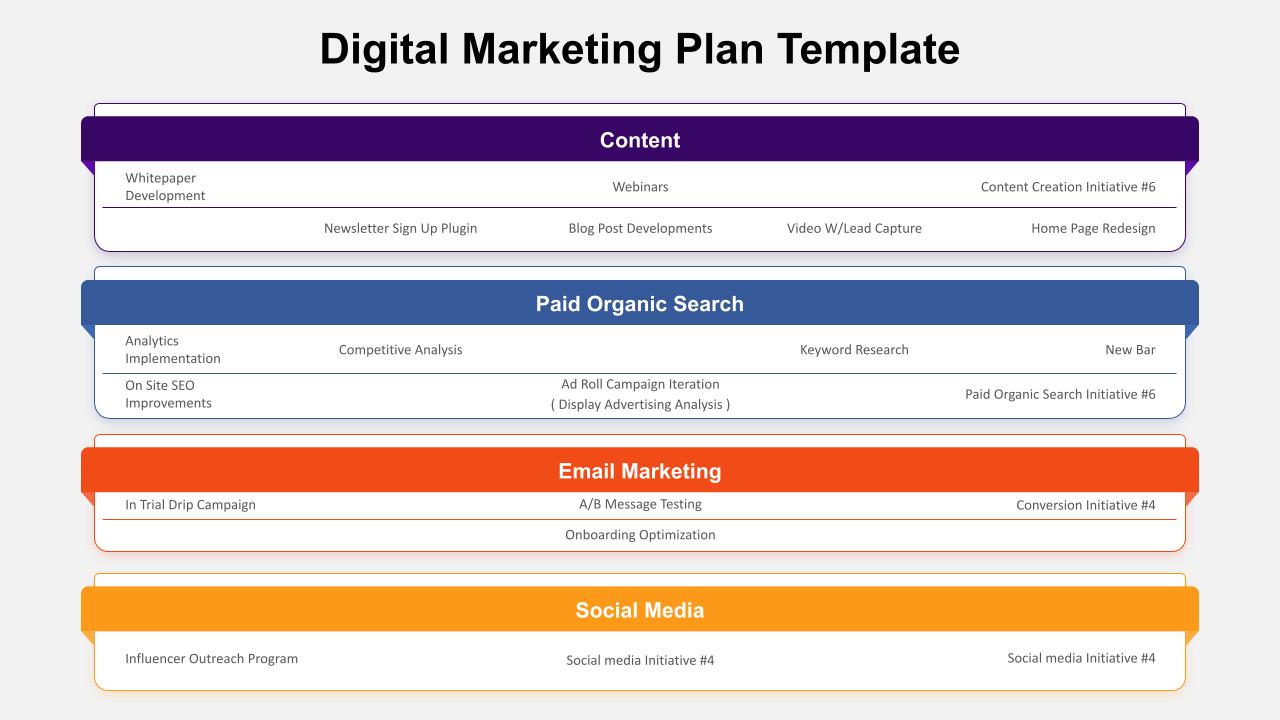

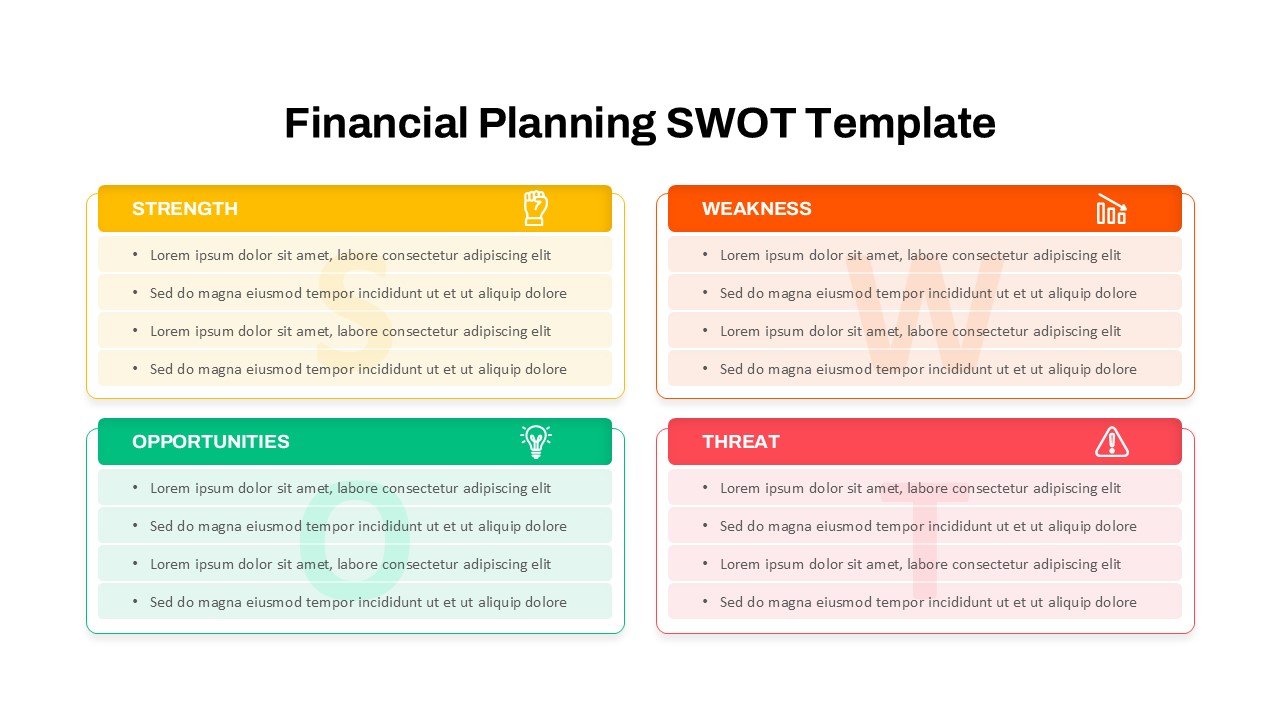

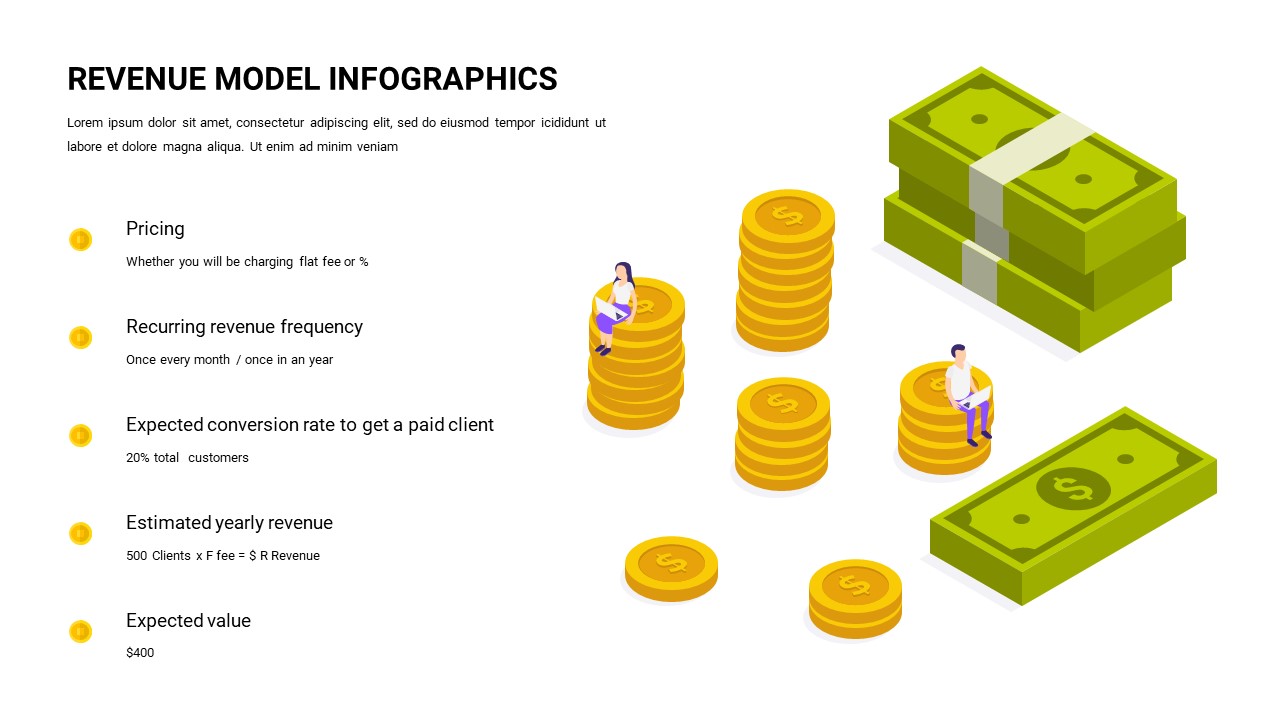

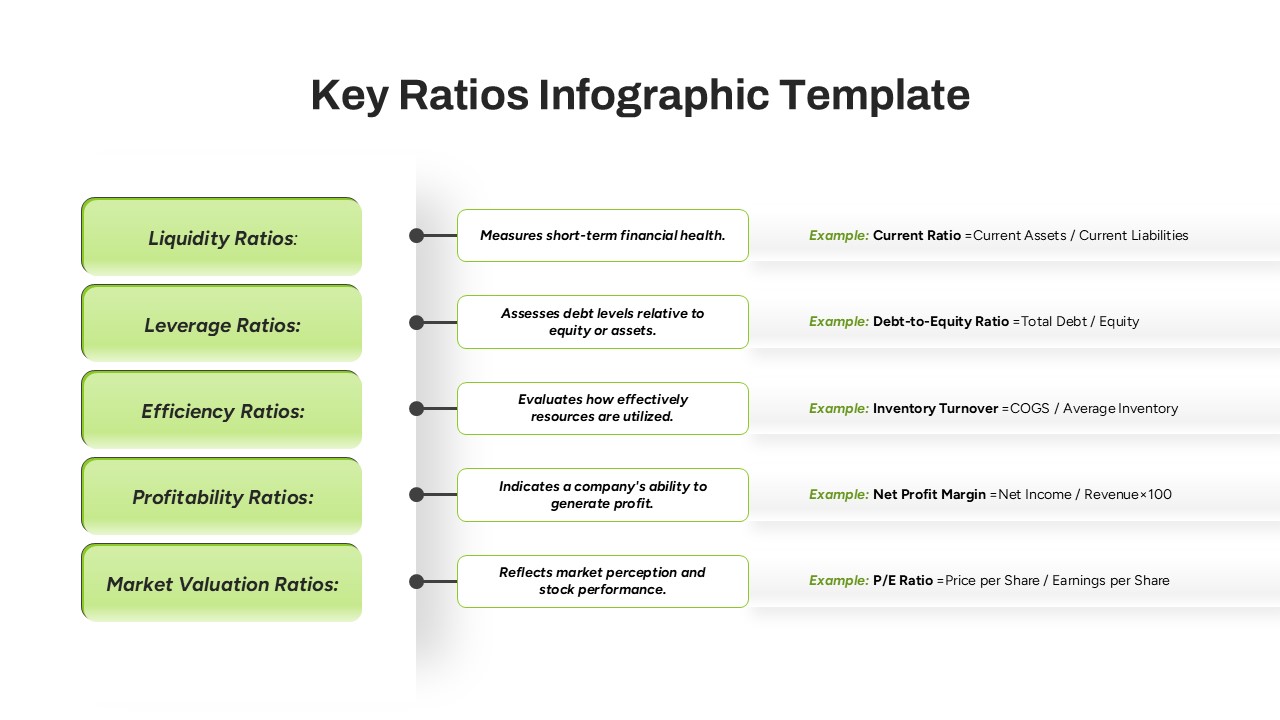

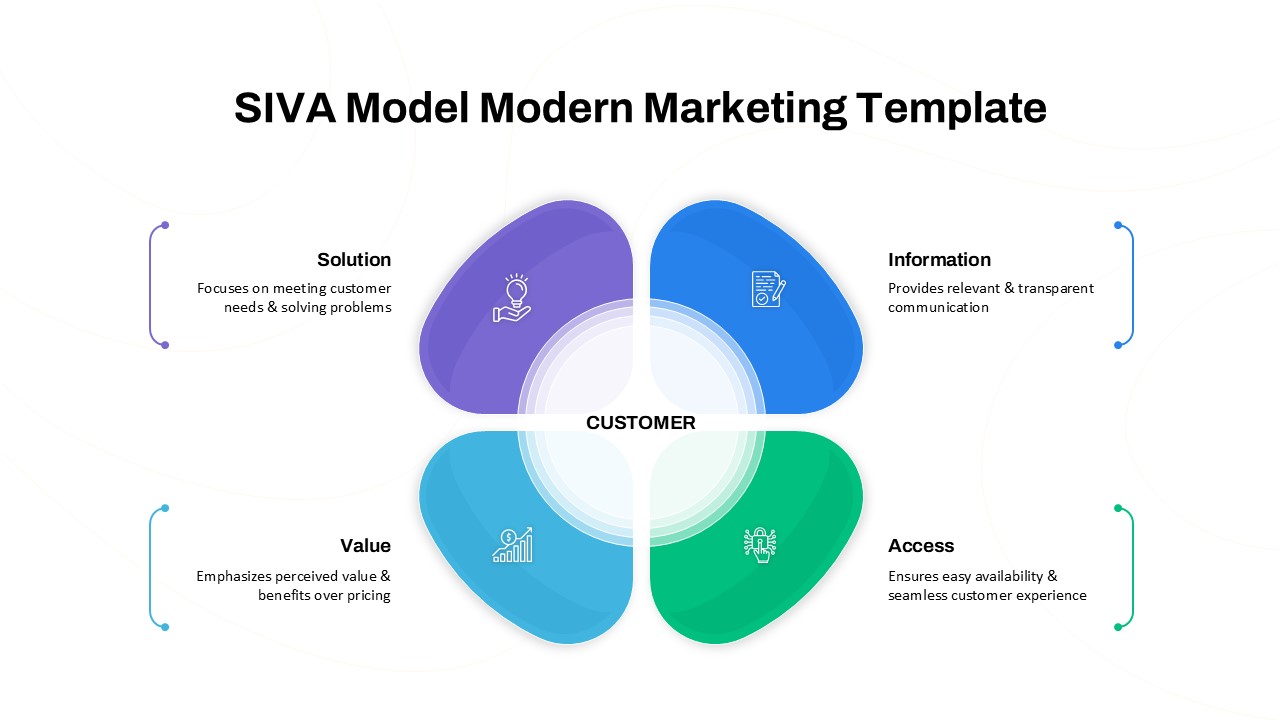

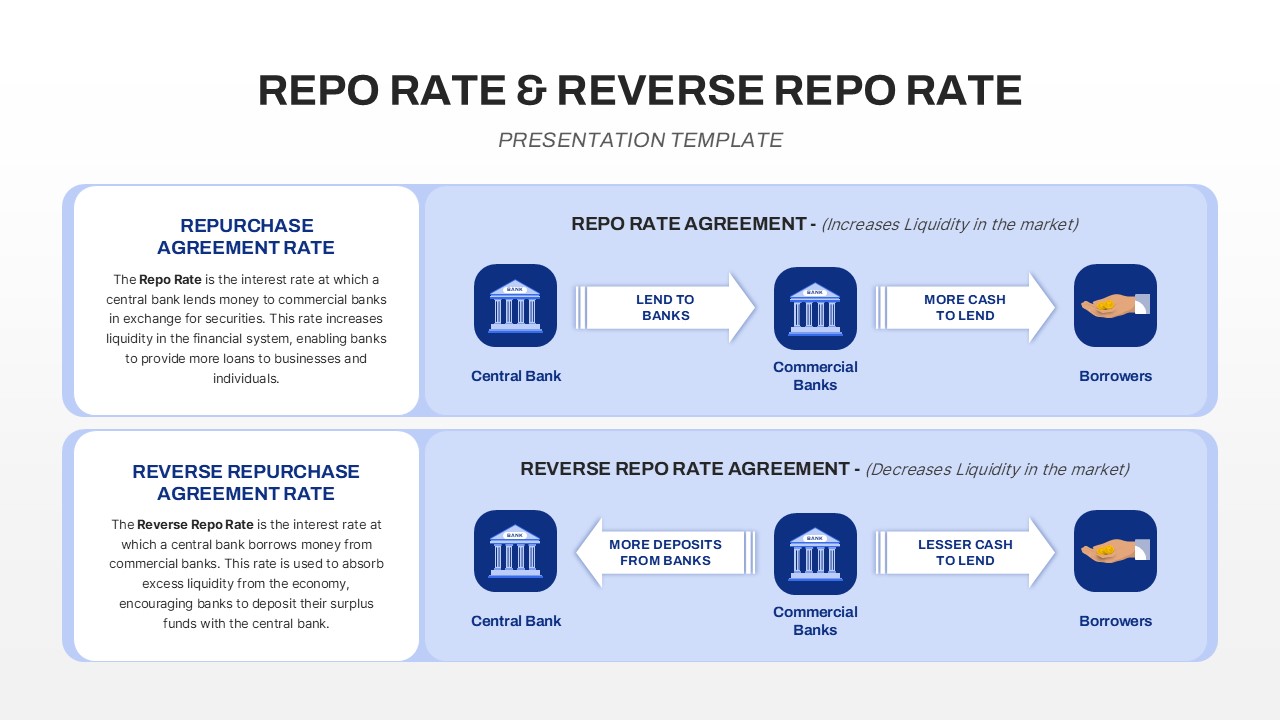

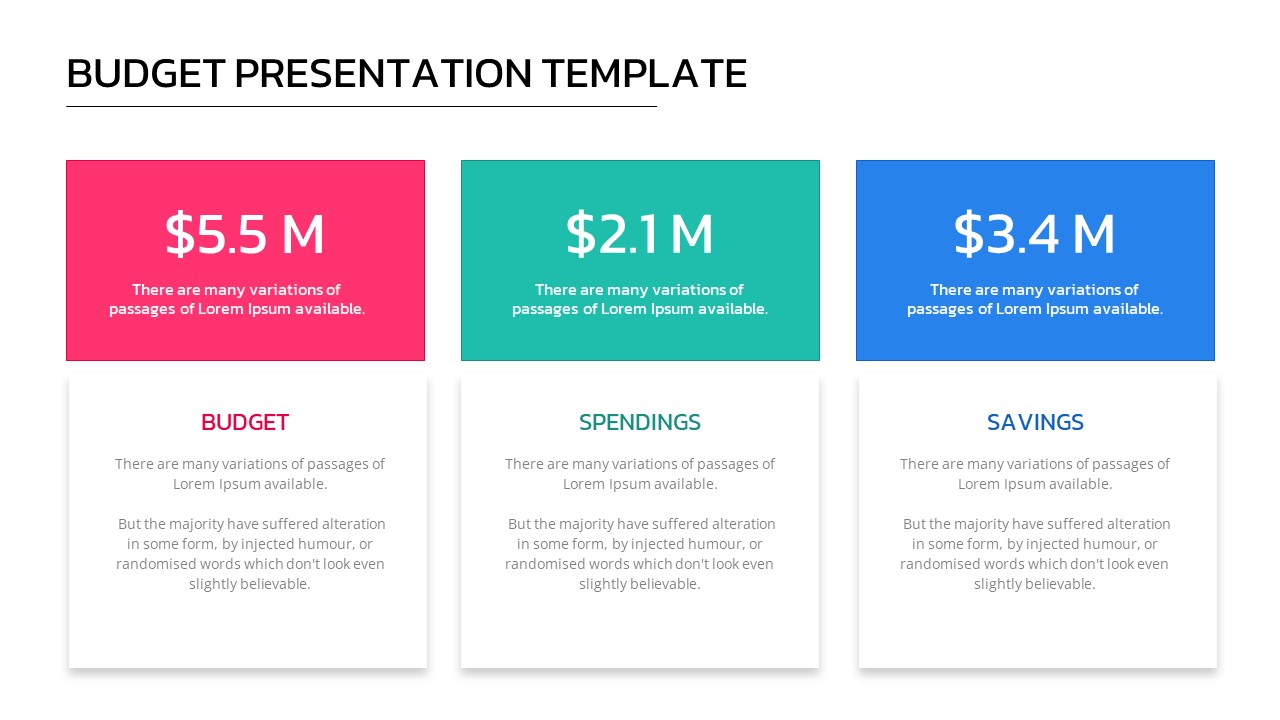

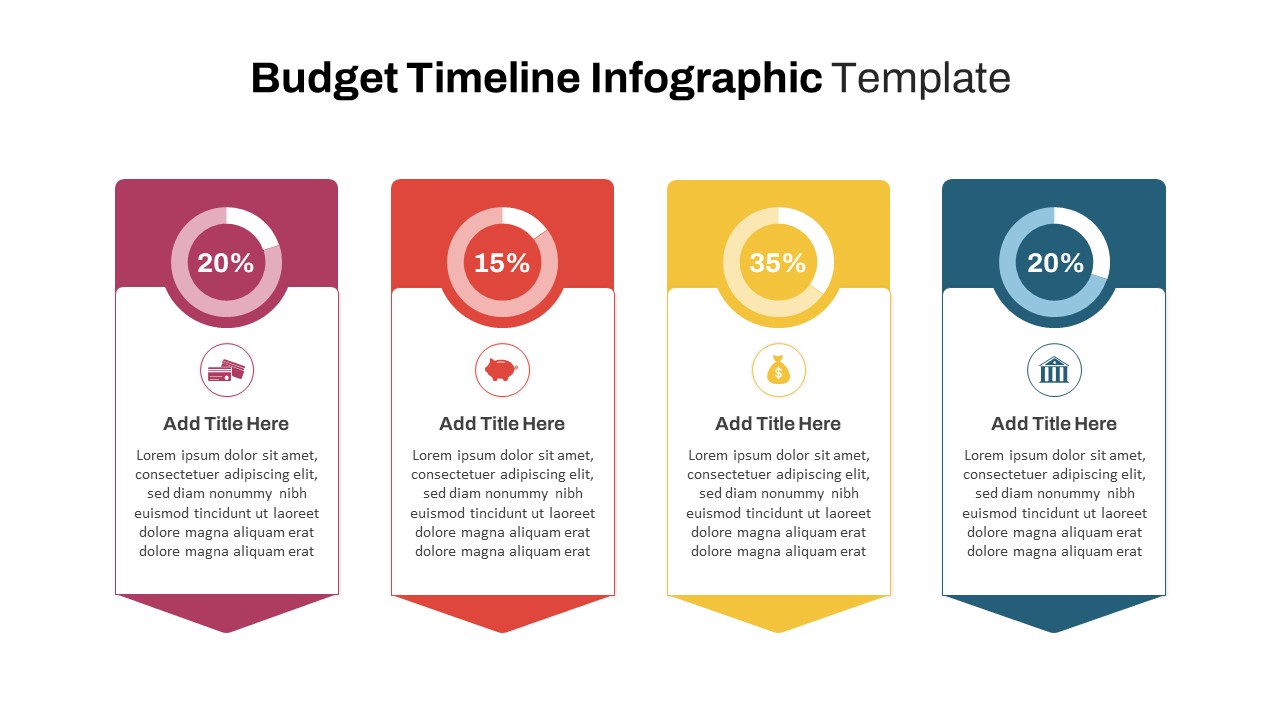

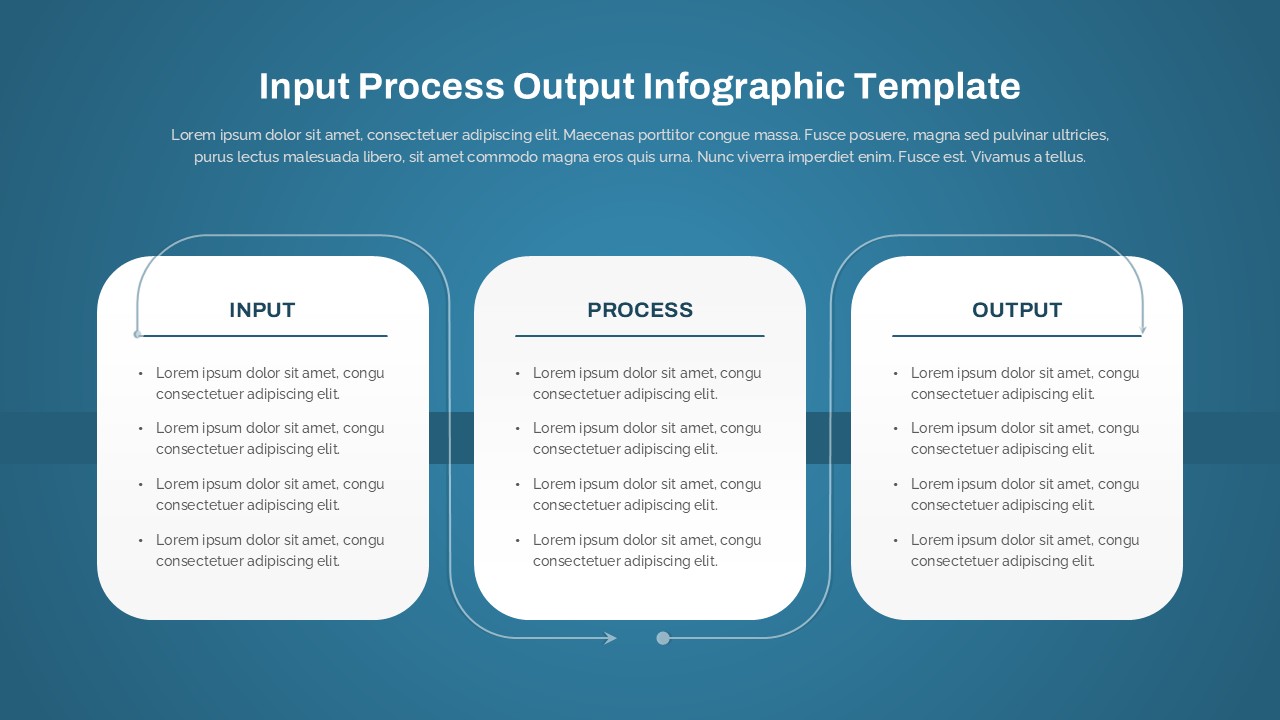

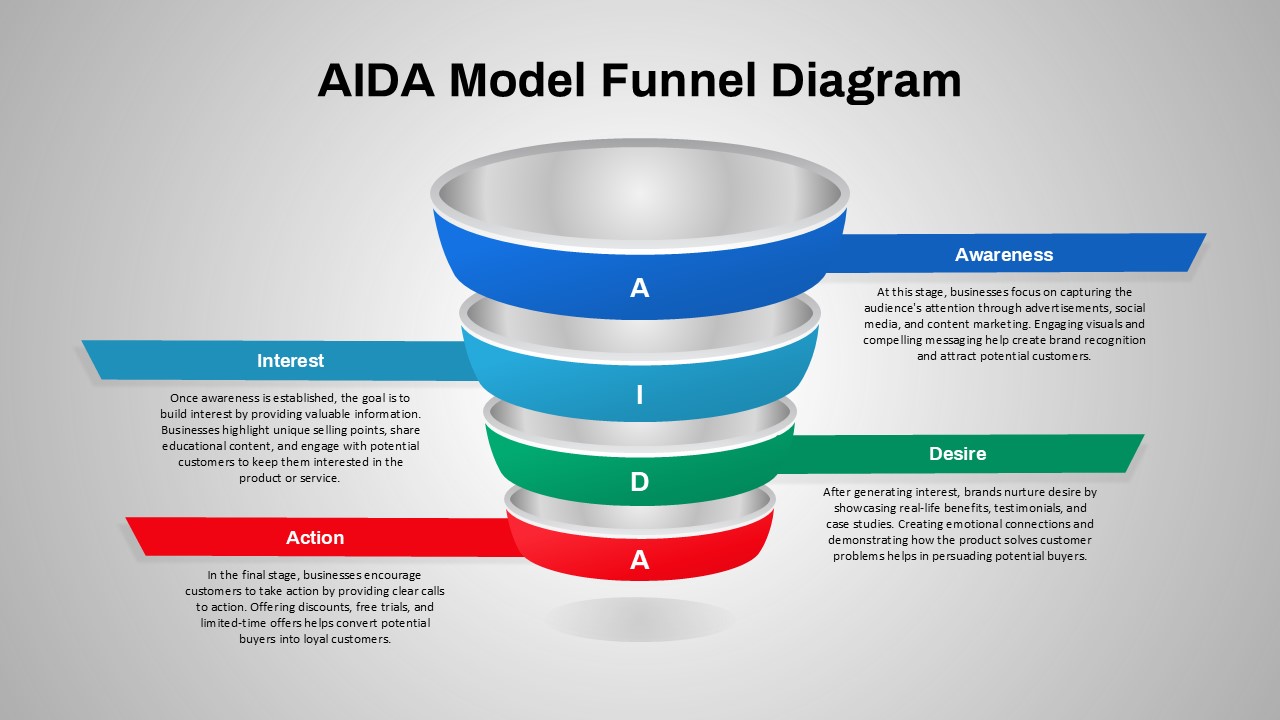

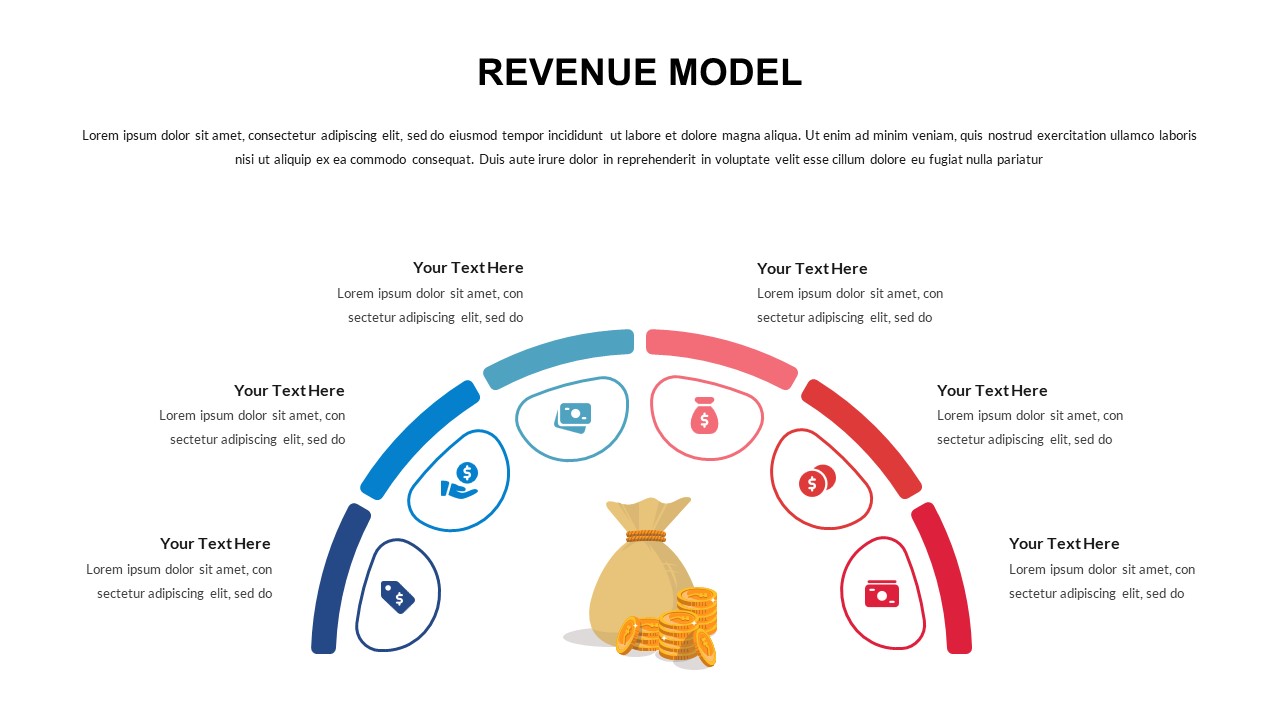

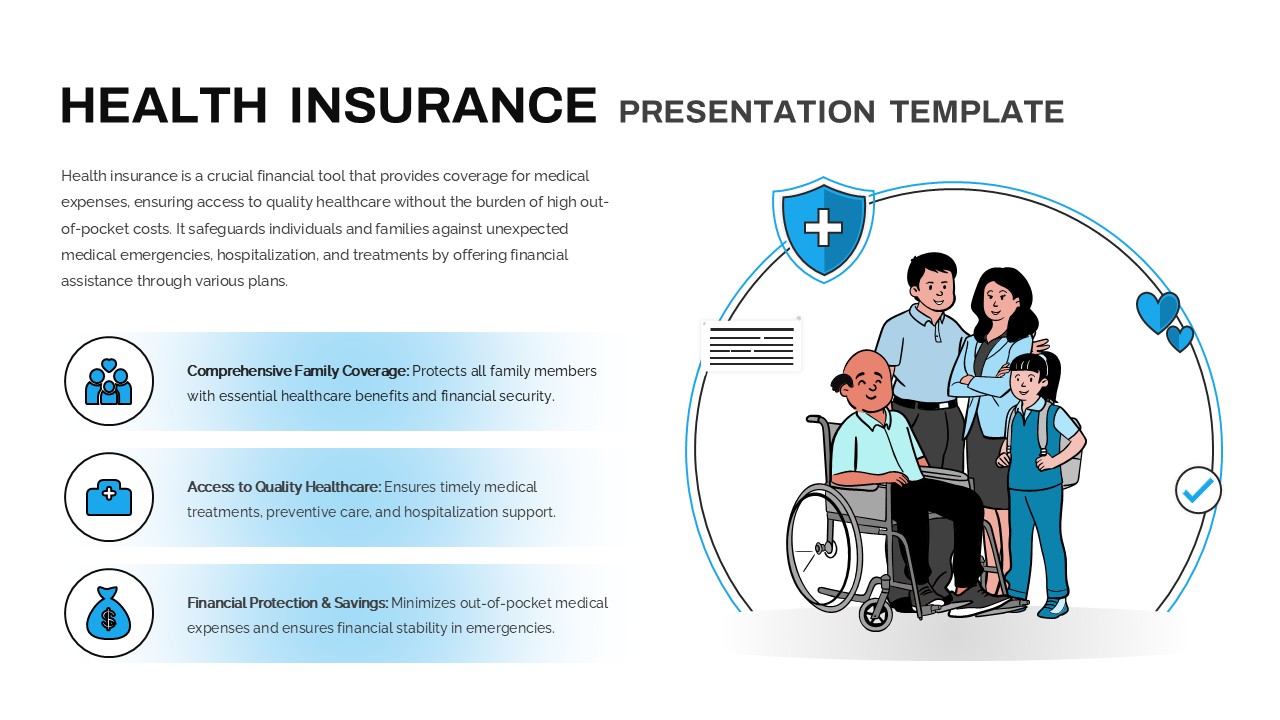

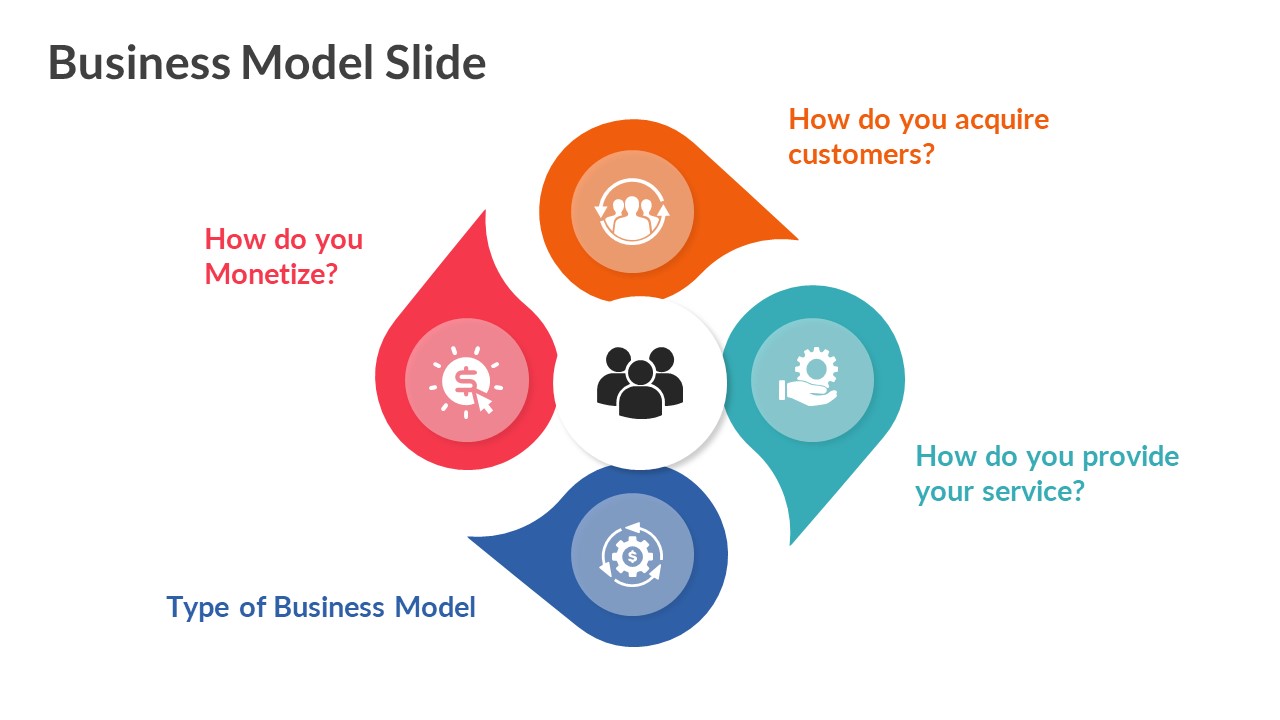

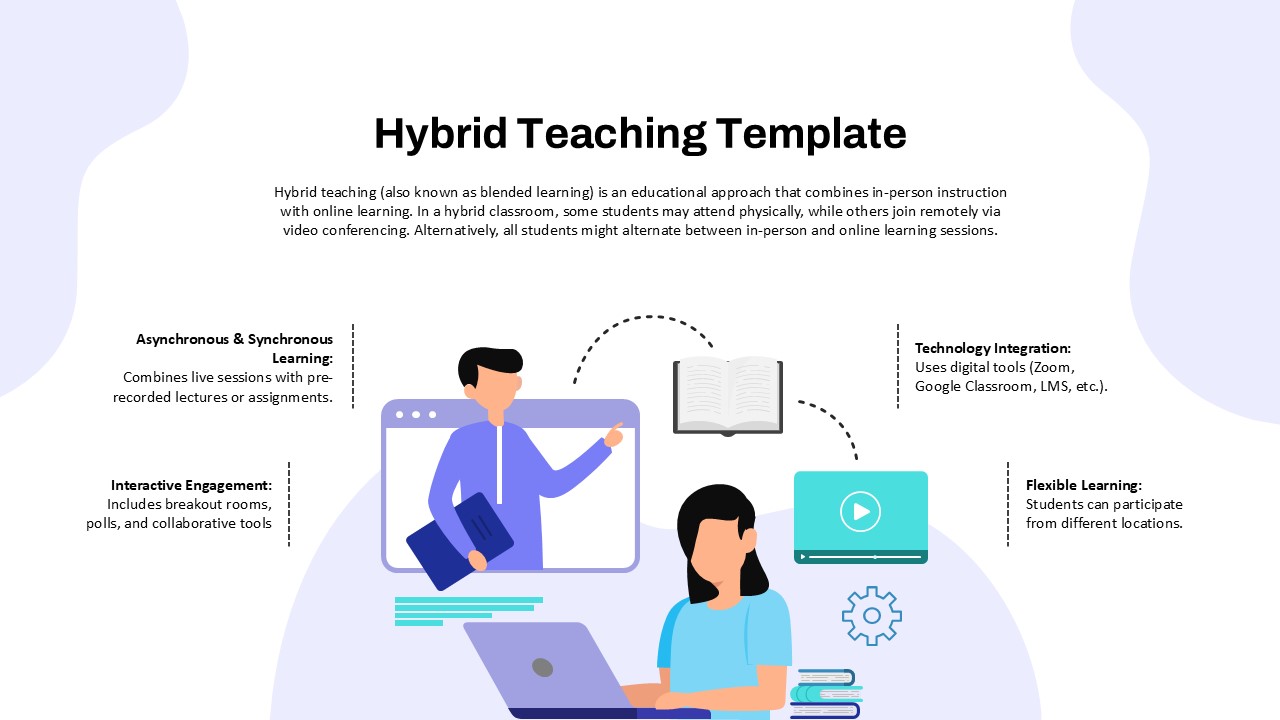

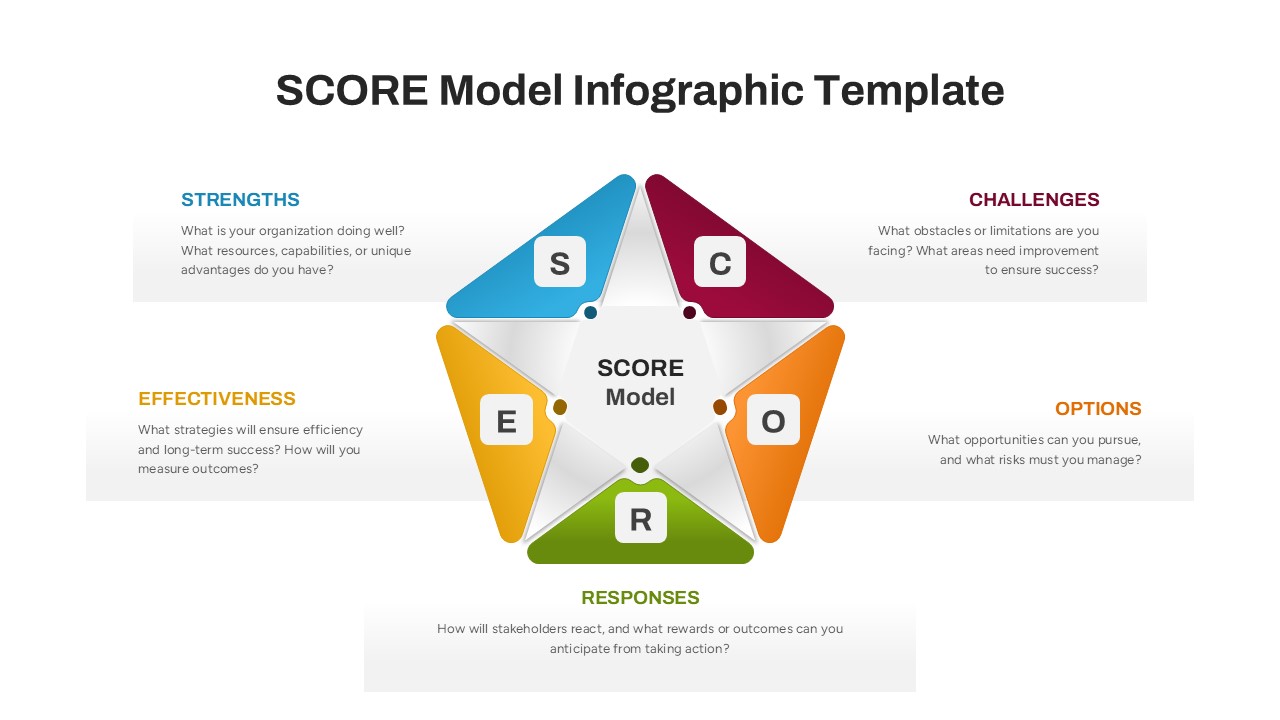

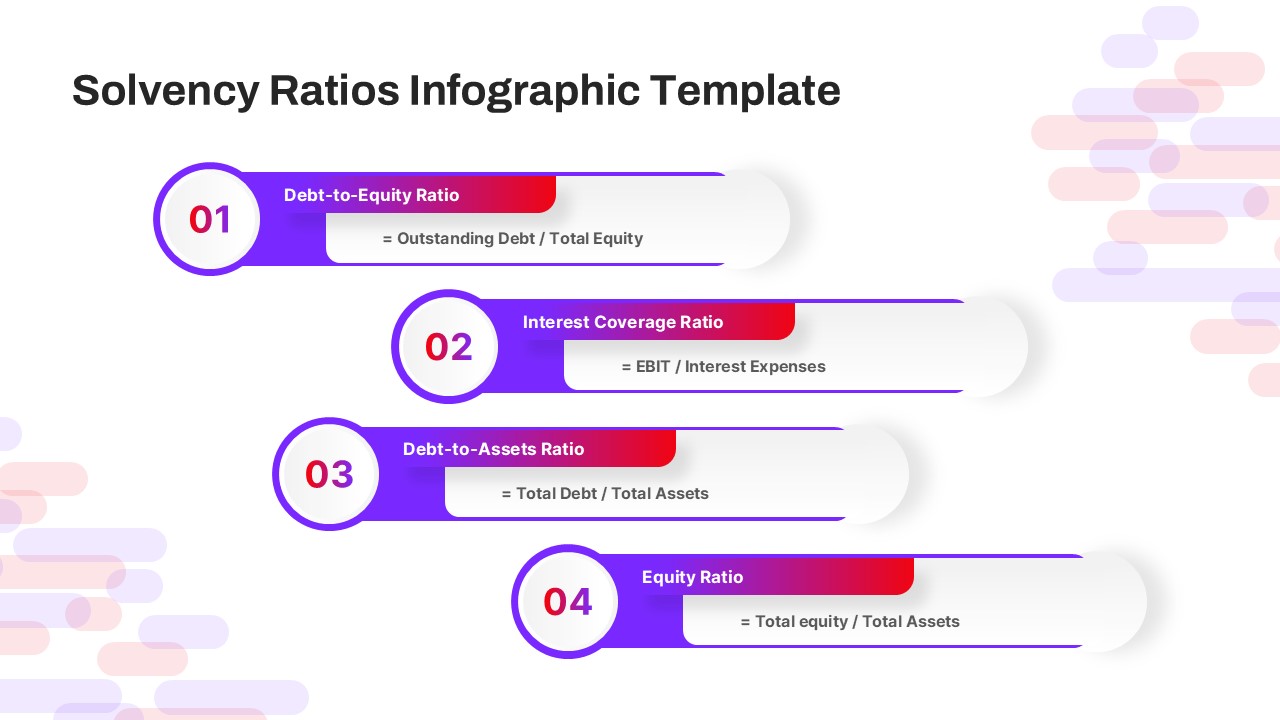

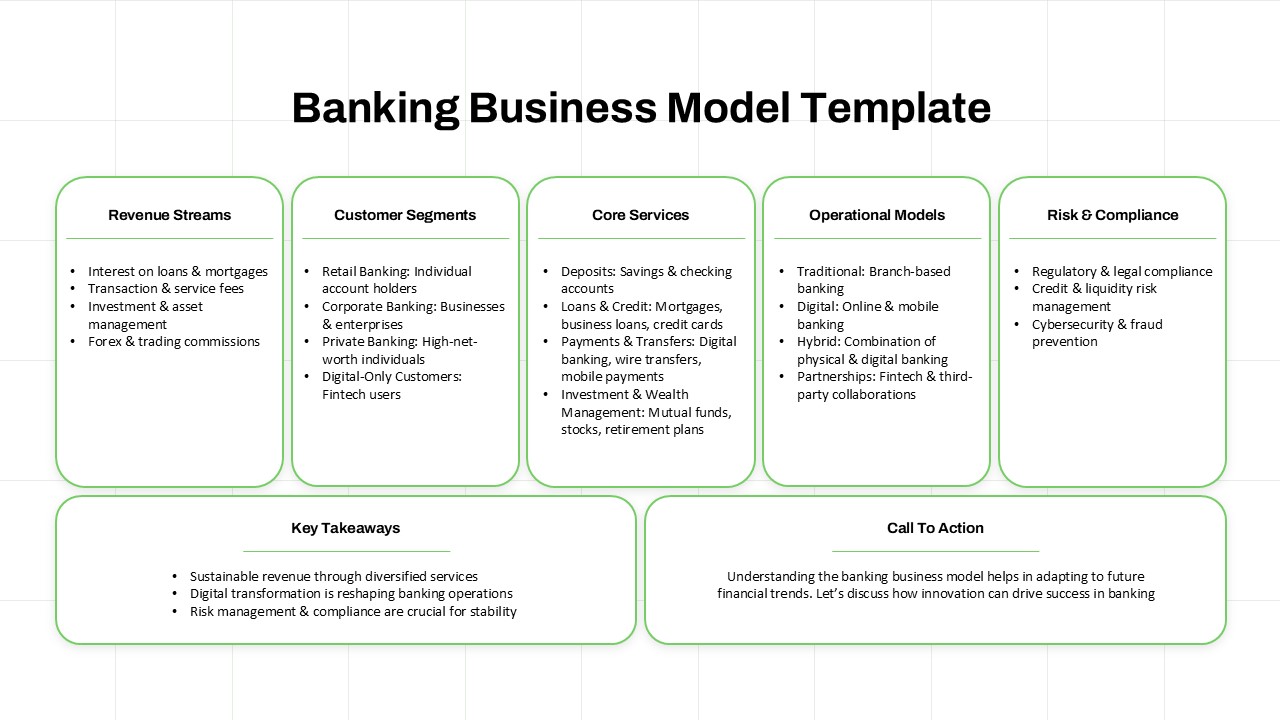

The template is divided into six main segments: Revenue Streams, Customer Segments, Core Services, Operational Models, Risk & Compliance, and a conclusive area for Key Takeaways and Call to Action. Each section is laid out in a card-style design, making the content easy to scan and visually engaging. From interest income and service fees to the evolution of hybrid and digital banking models, this slide effectively summarizes the operational logic behind modern banks.

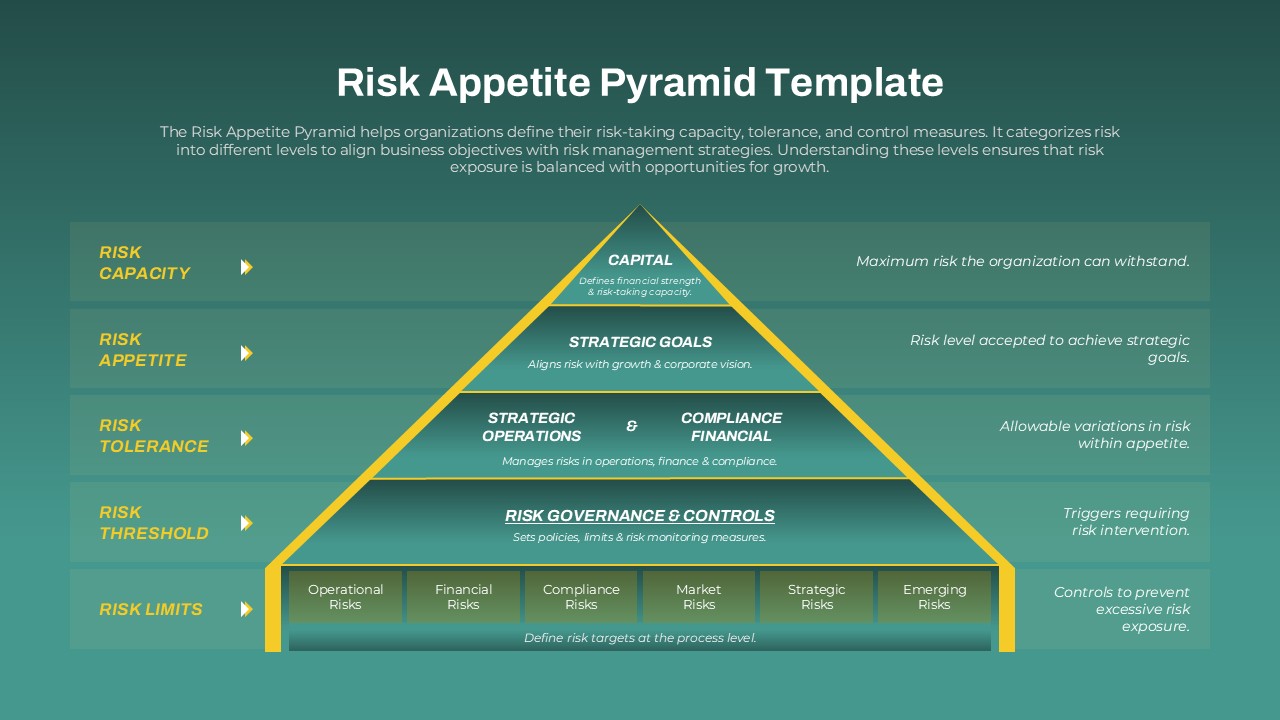

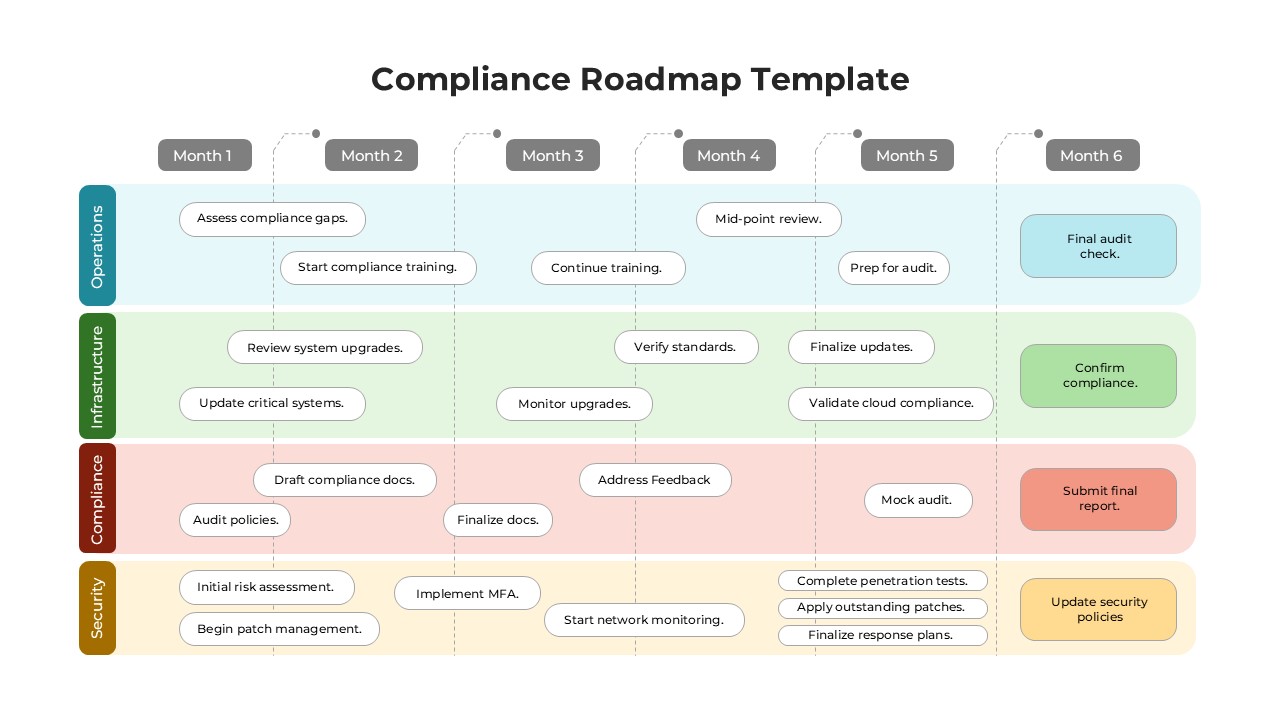

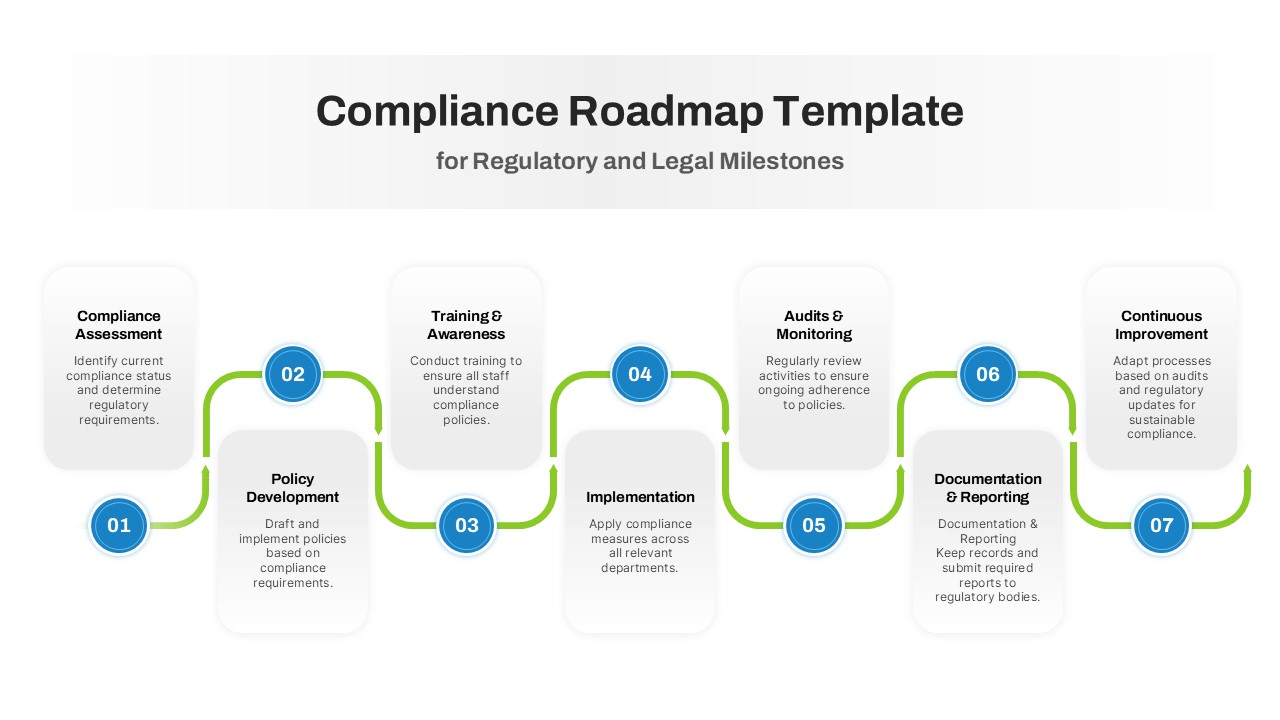

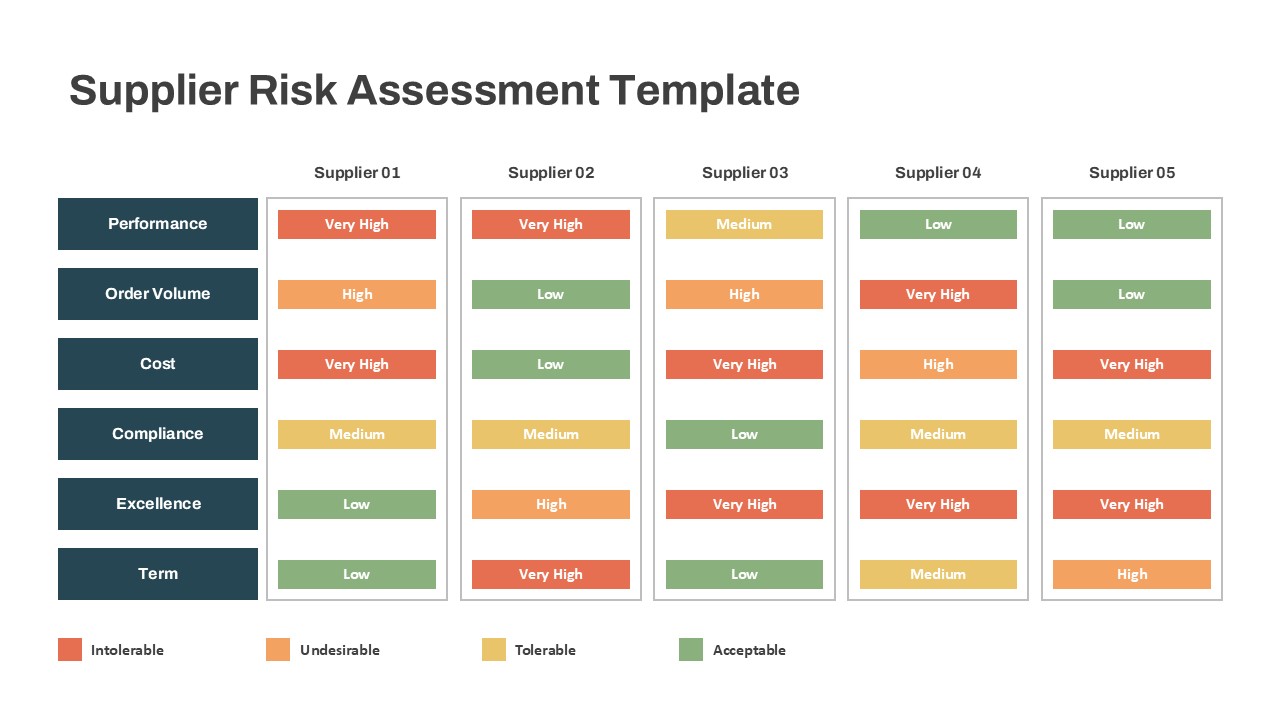

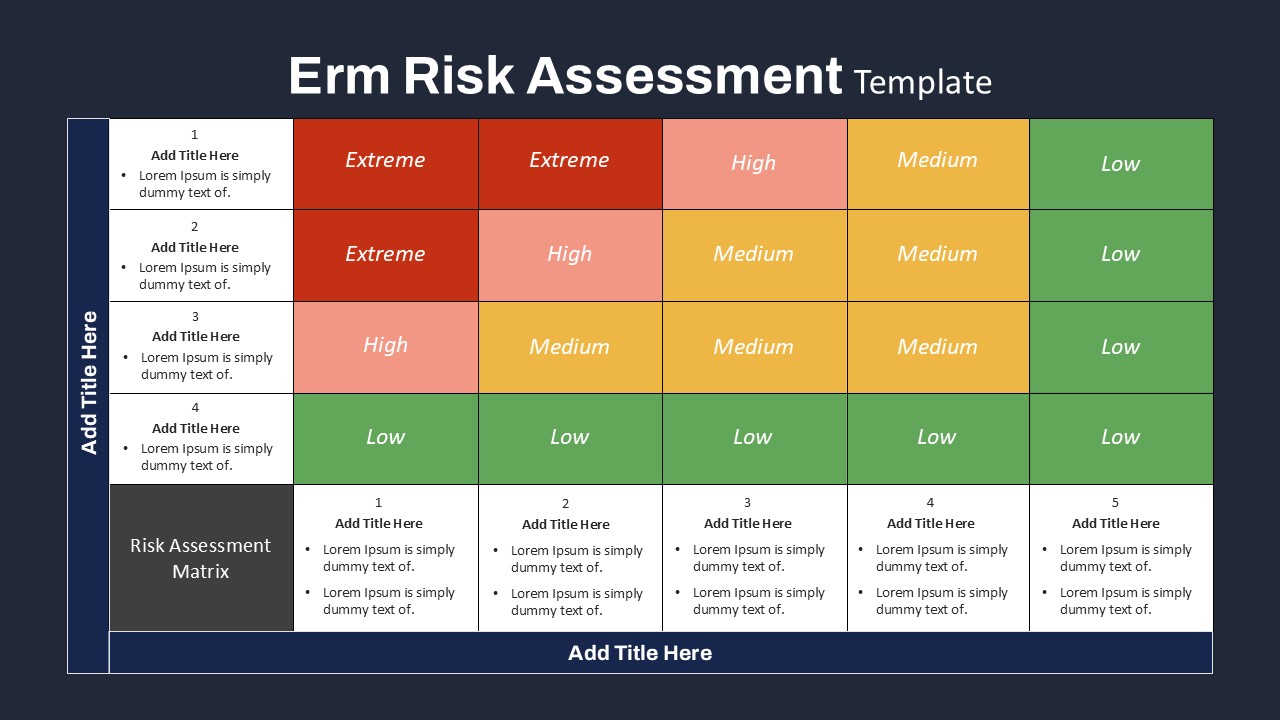

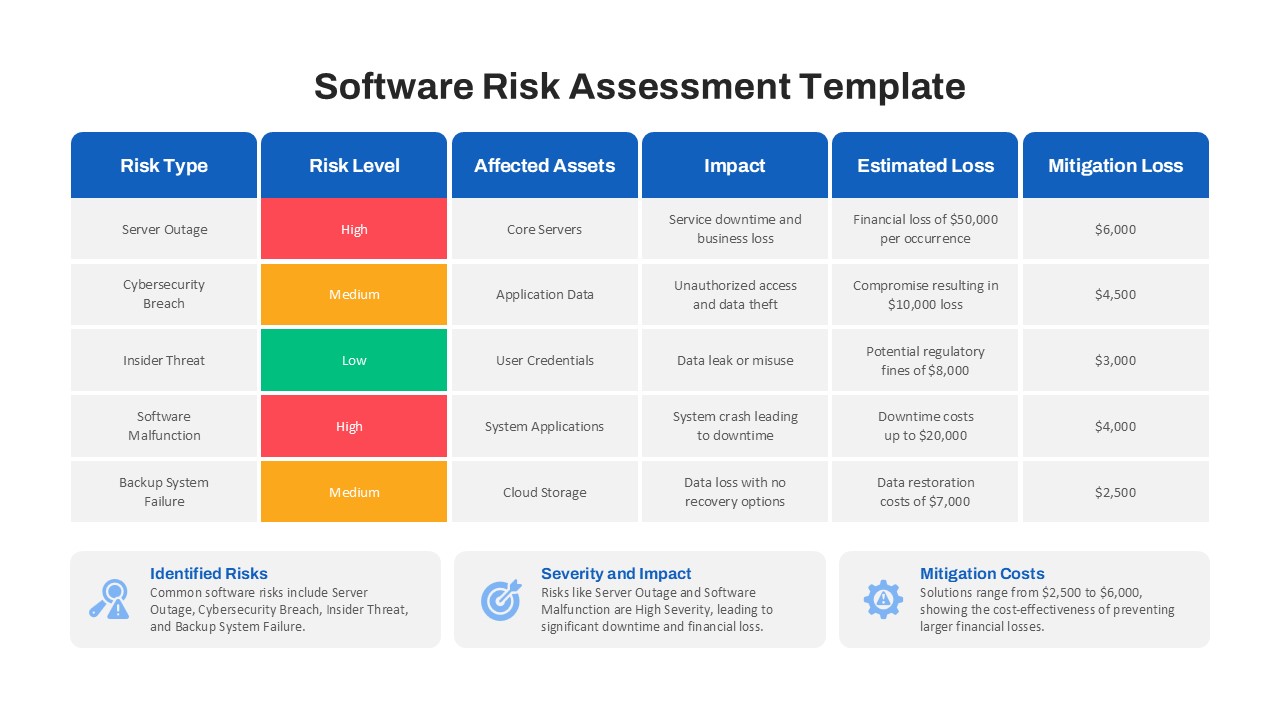

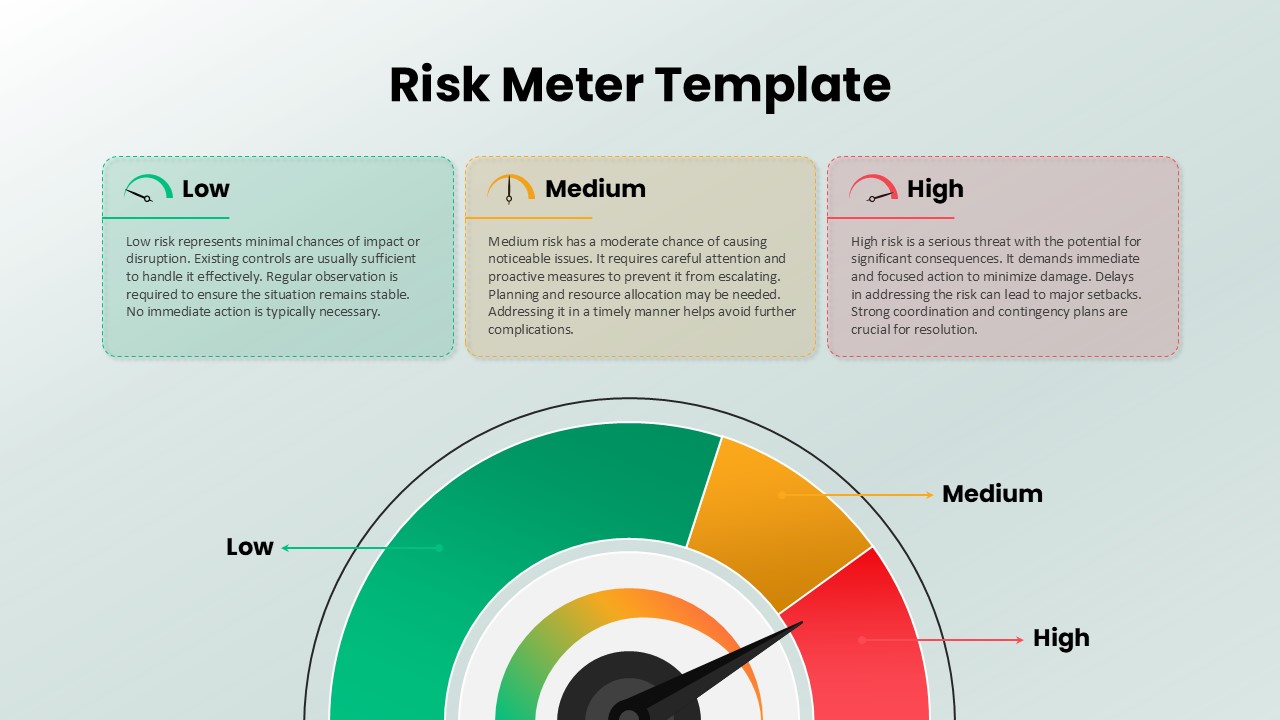

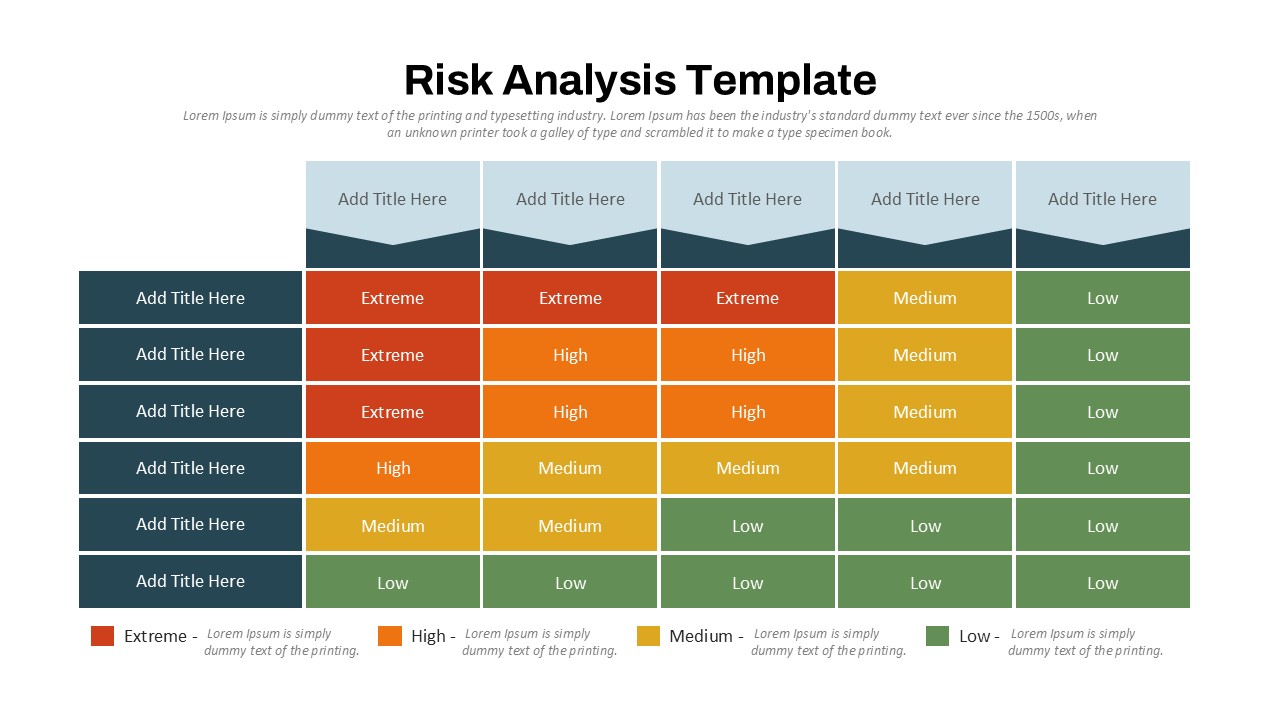

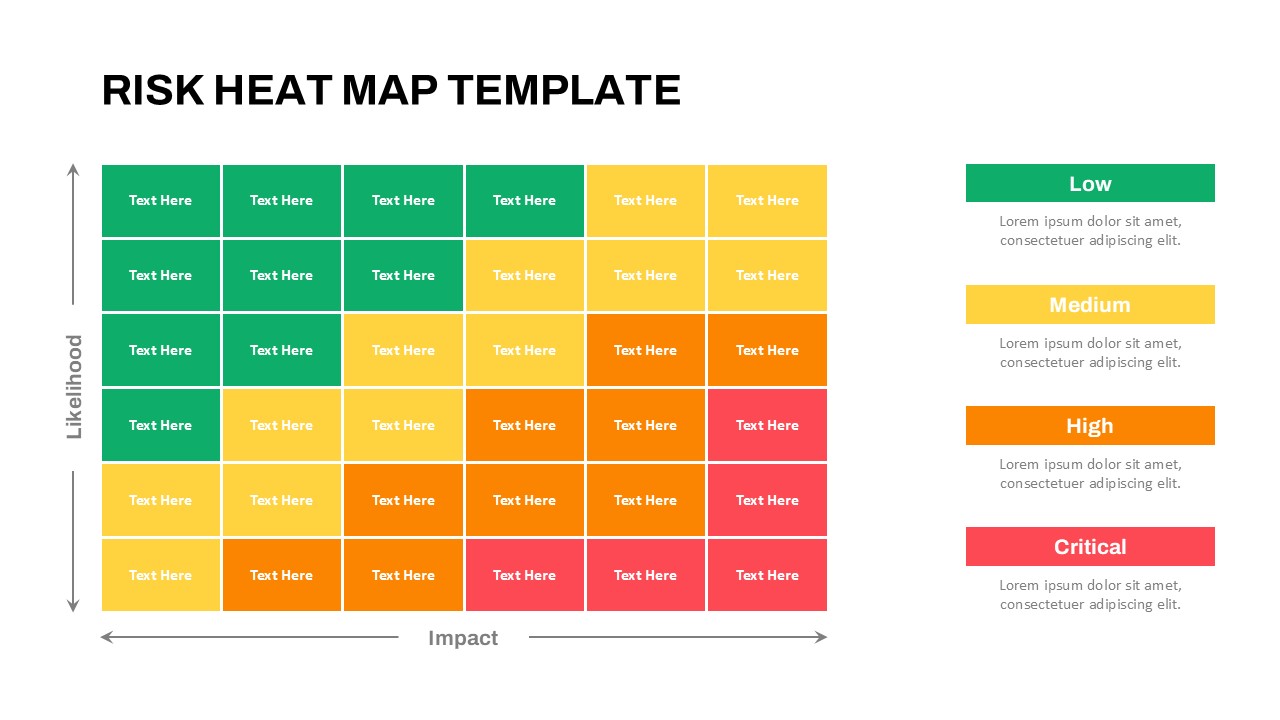

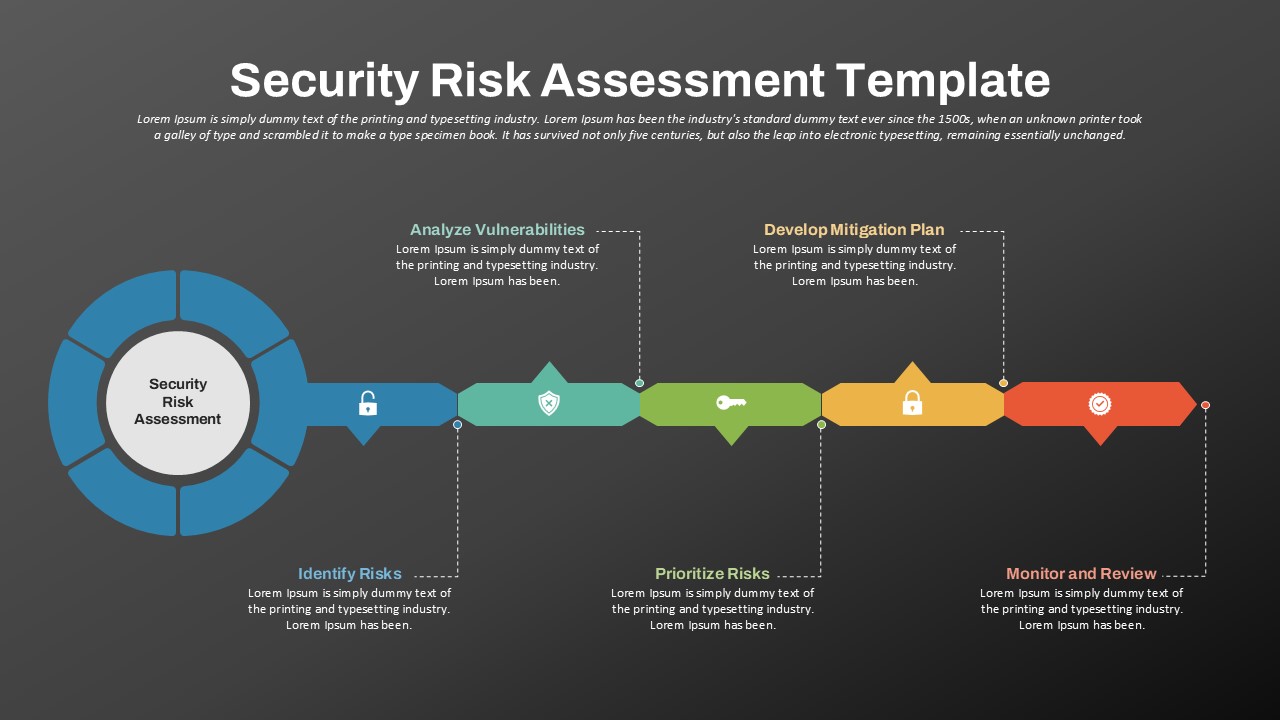

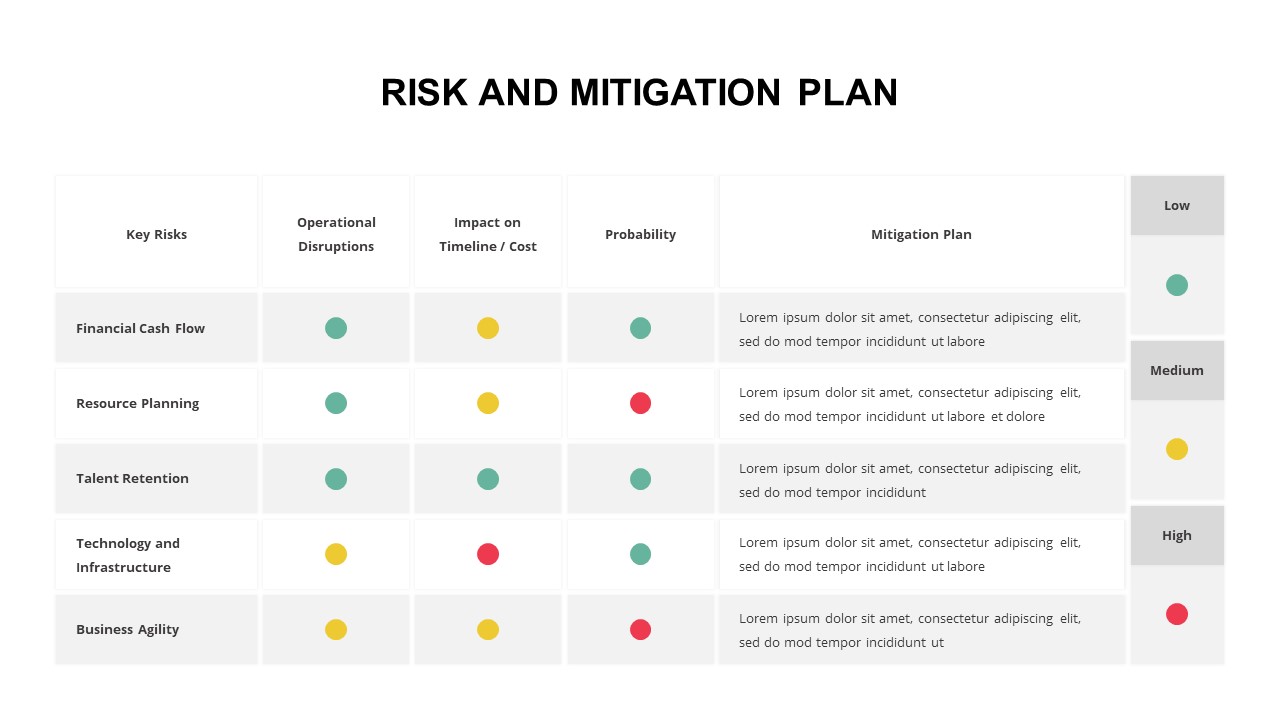

The template also highlights critical compliance aspects such as risk management, legal regulations, and cybersecurity—key areas in today’s digital-first financial landscape. It wraps up with actionable insights and a call to engage the audience in discussions about innovation and future readiness.

Ideal for strategy meetings, client presentations, investor pitch decks, or educational lectures, this template is fully customizable in both PowerPoint and Google Slides. It allows financial professionals to tailor the content to suit various business contexts, whether explaining value creation to stakeholders or teaching students about the intricacies of the financial sector.

See more

Features of this template

Other User Cases of the Template

Financial strategy presentations, fintech business planning, investor pitch decks, banking sector workshops, university finance lectures, digital banking transformation meetings, risk management briefings, internal training sessions, client consulting reports, business model analysis for startups