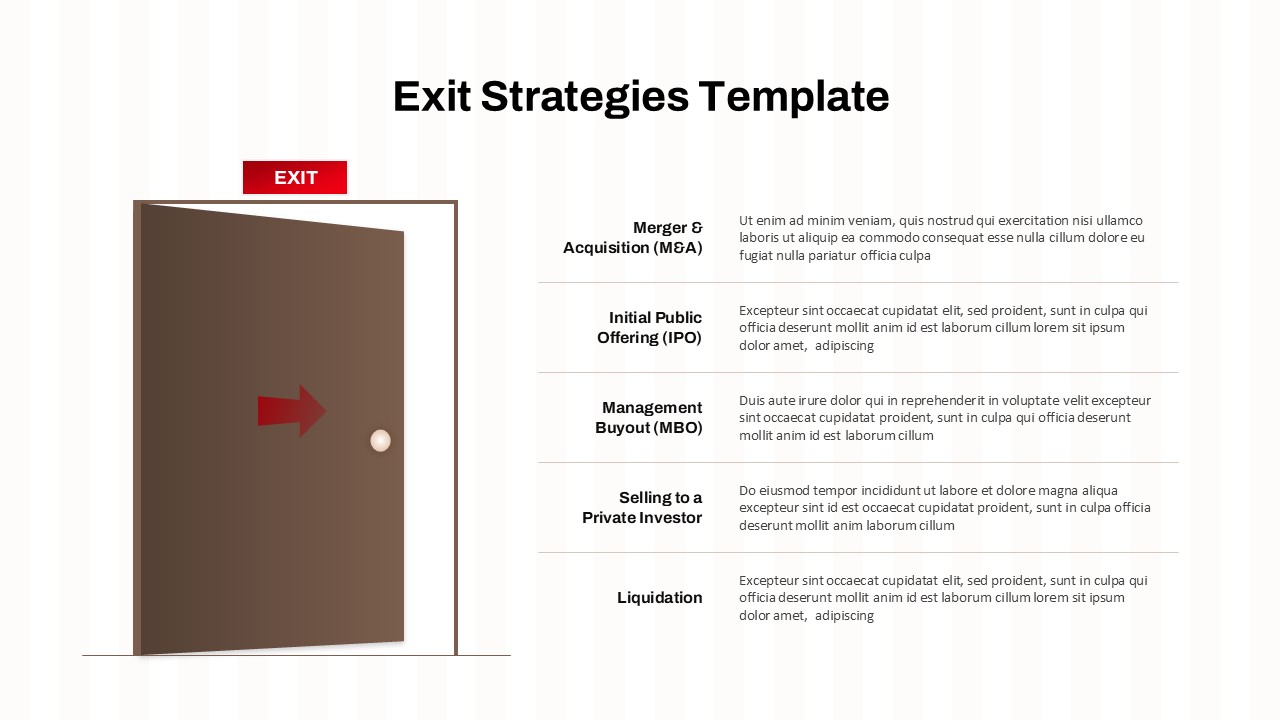

Merger and Acquisition (M&A) Presentation Template

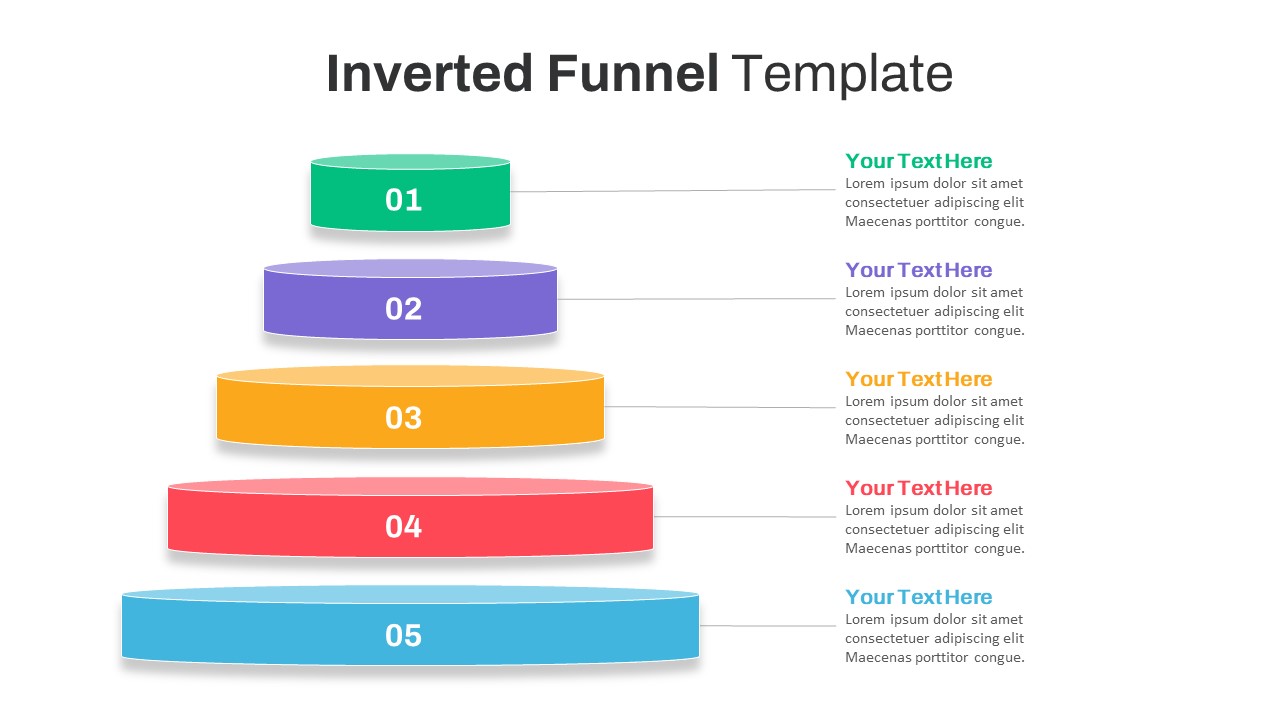

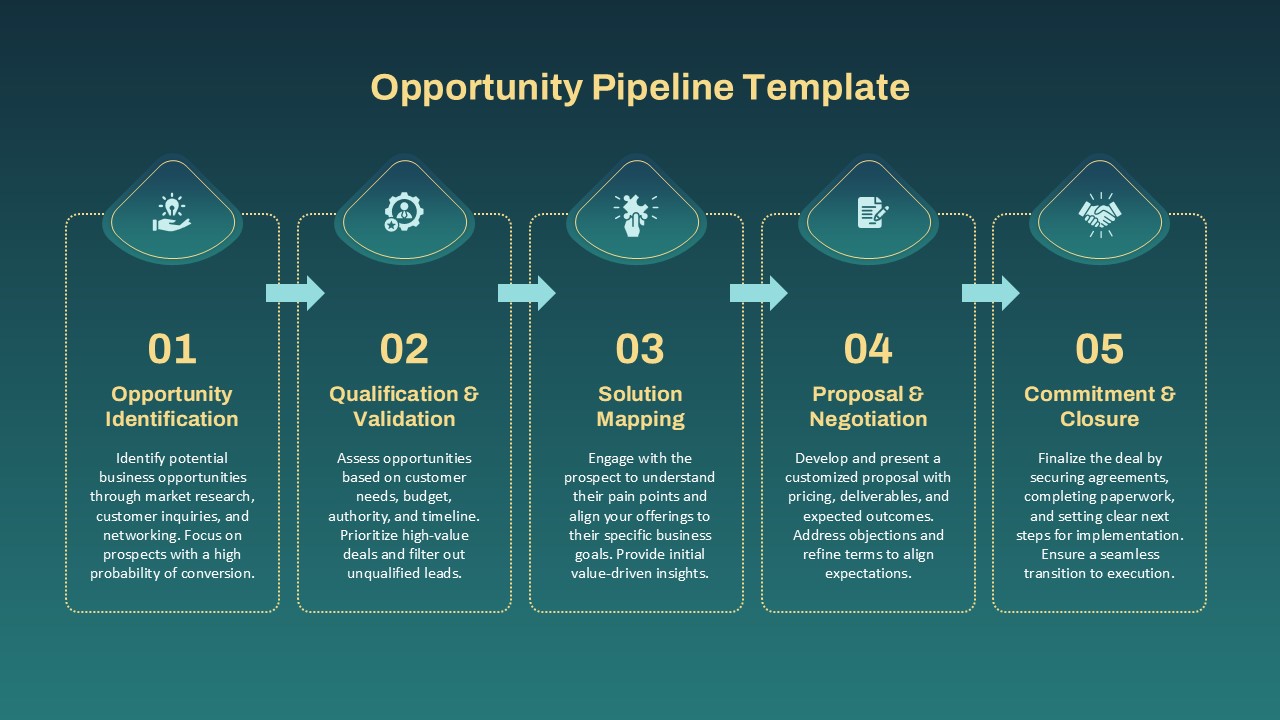

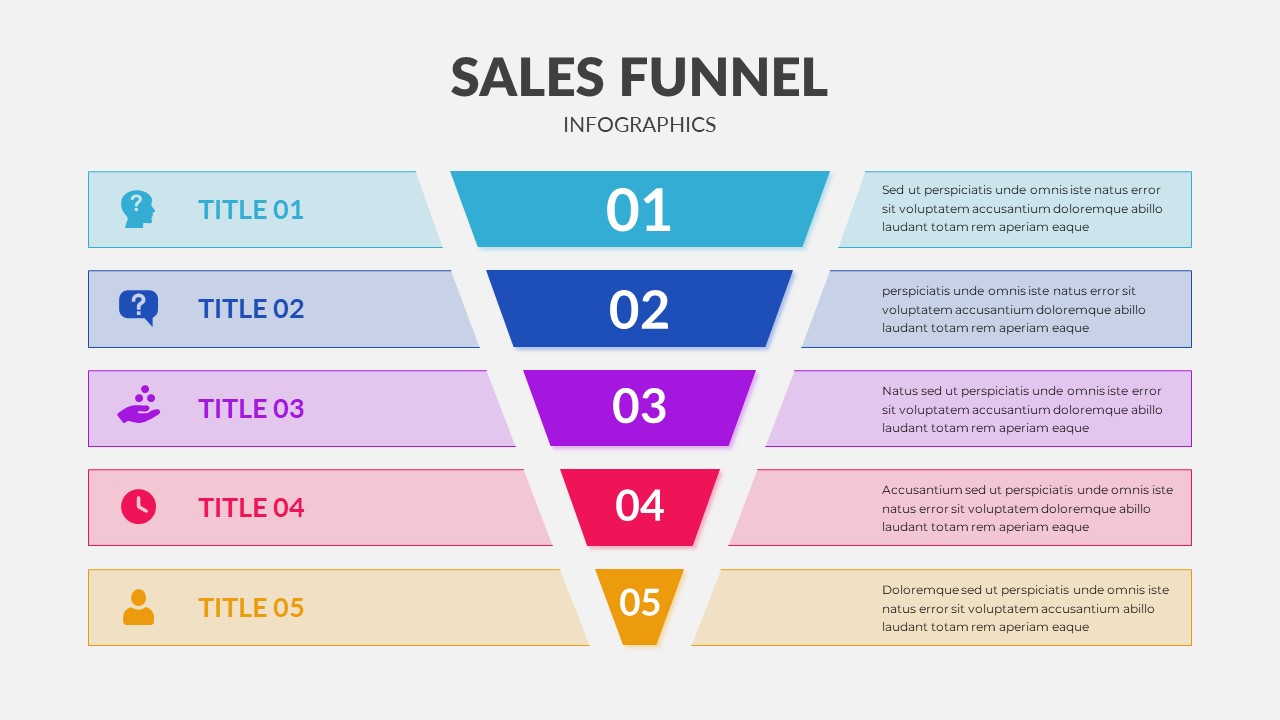

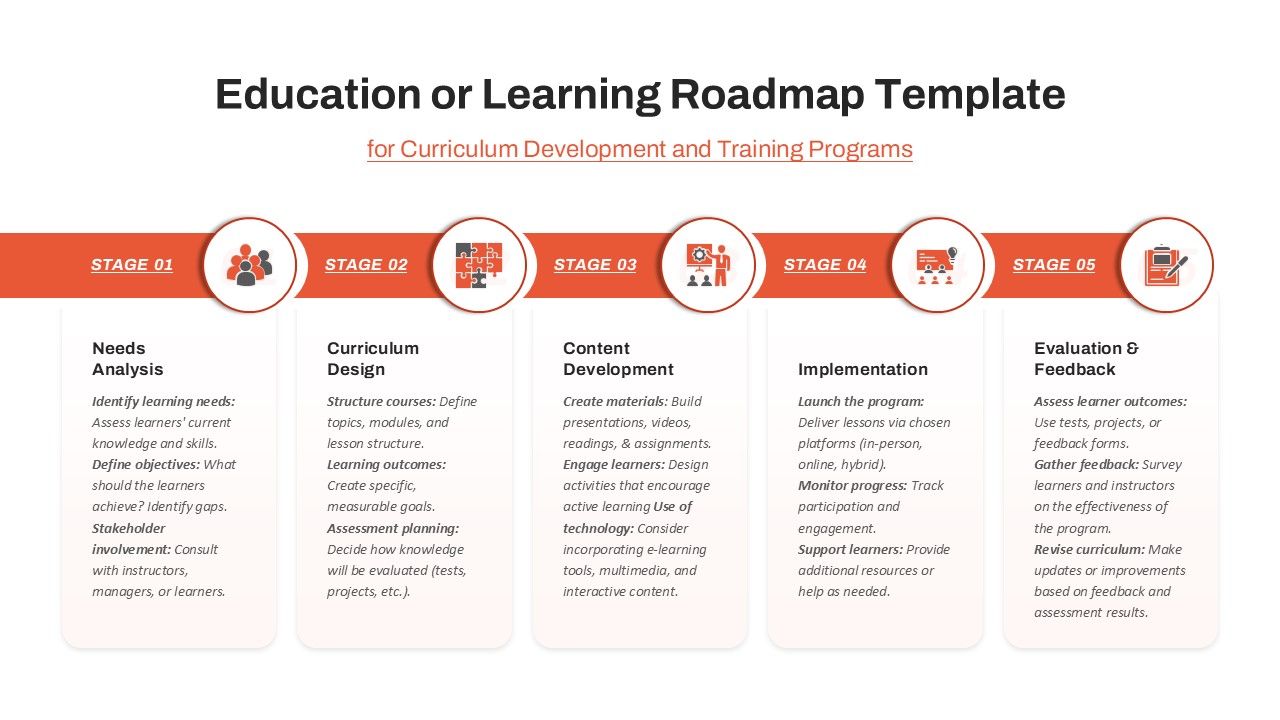

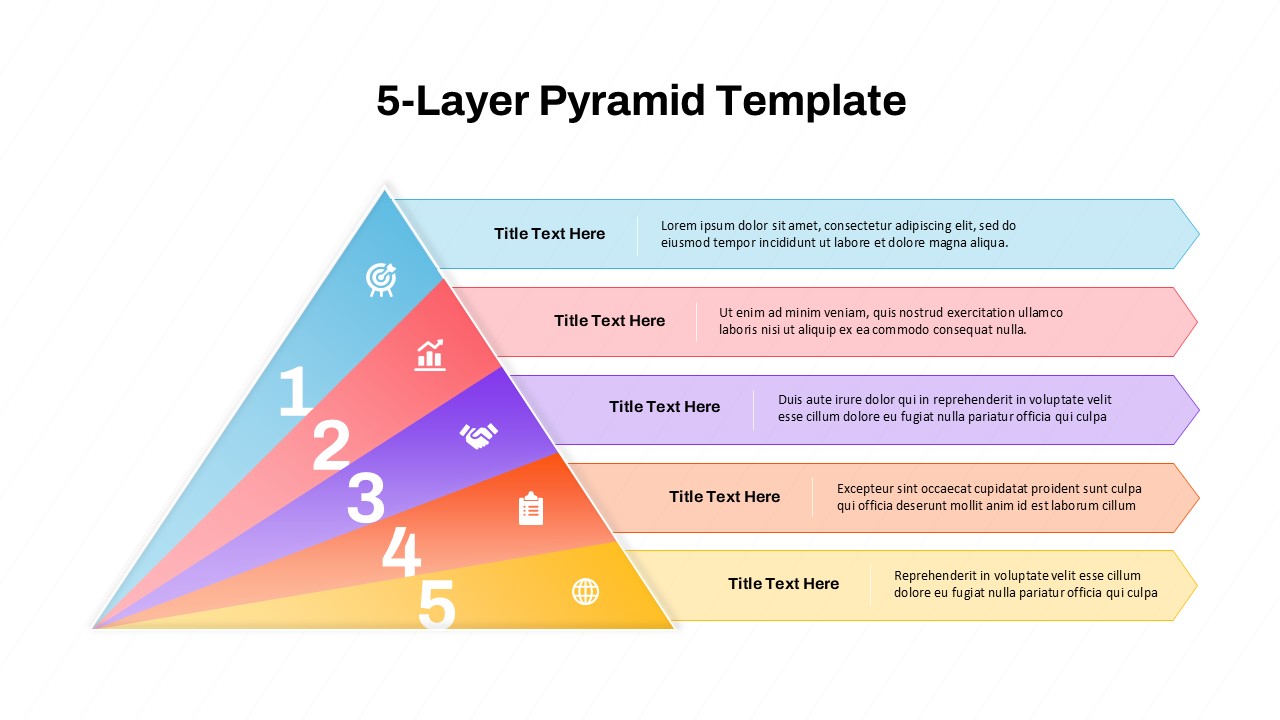

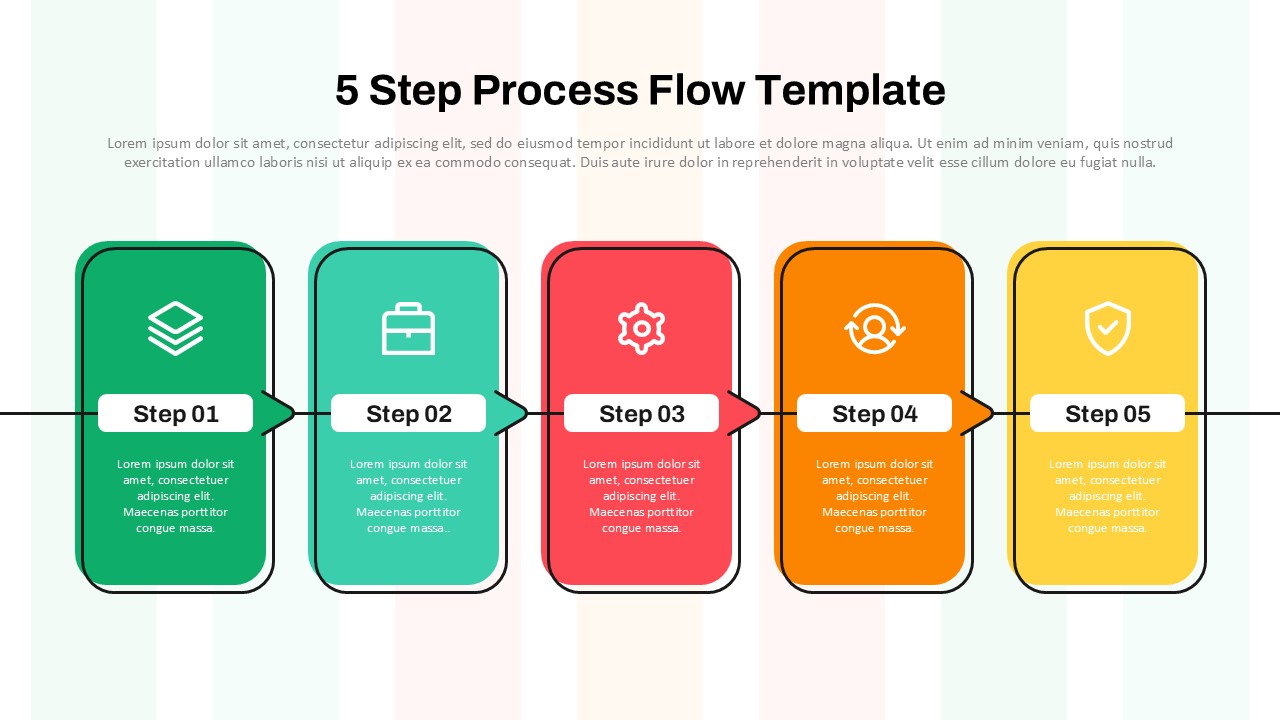

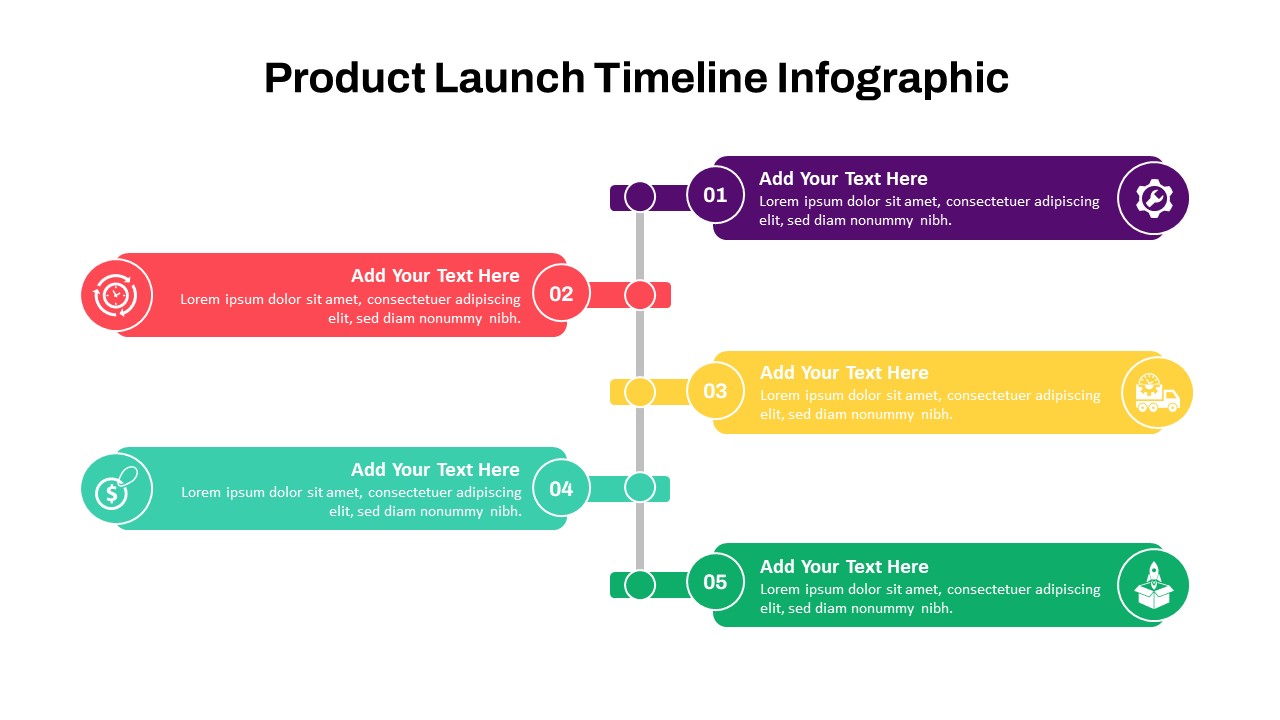

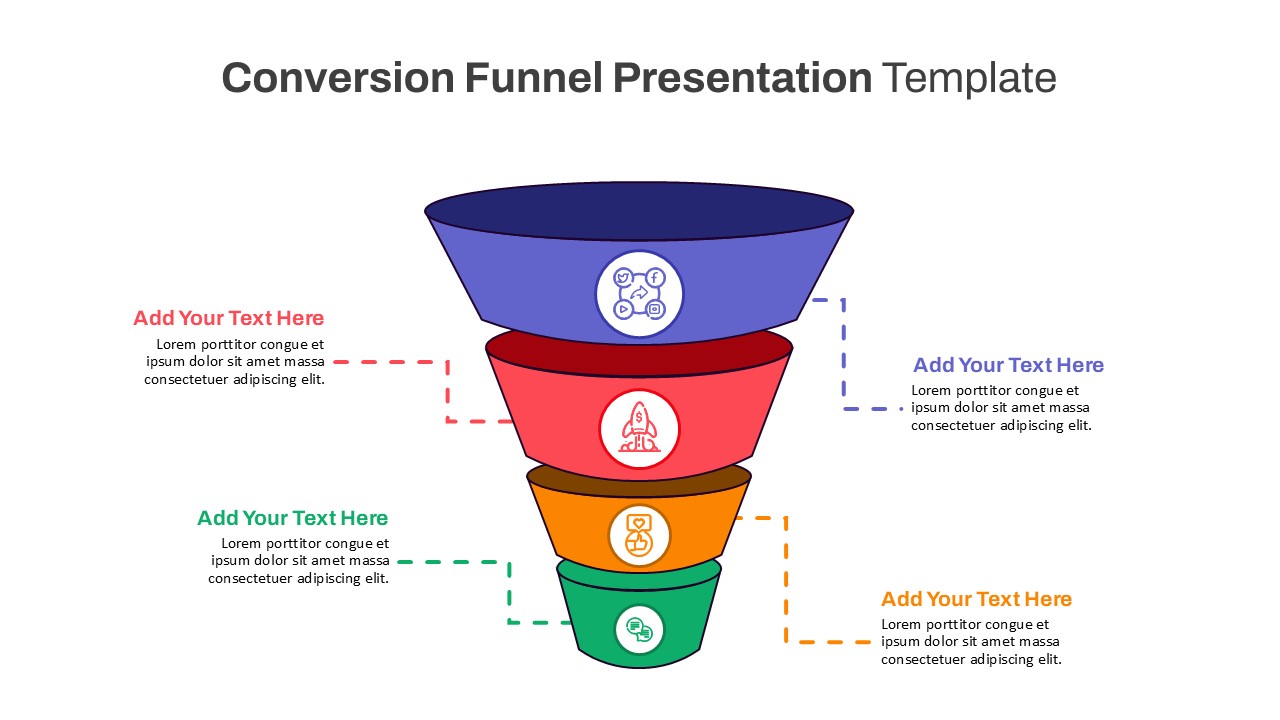

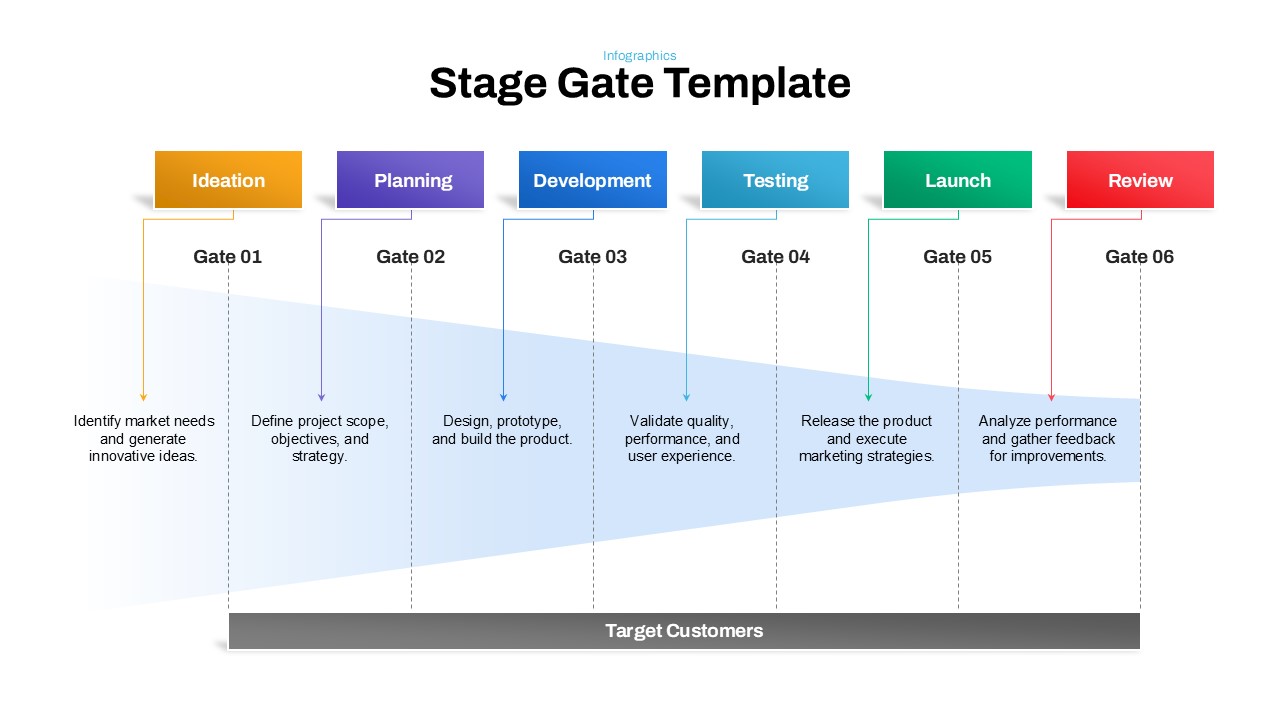

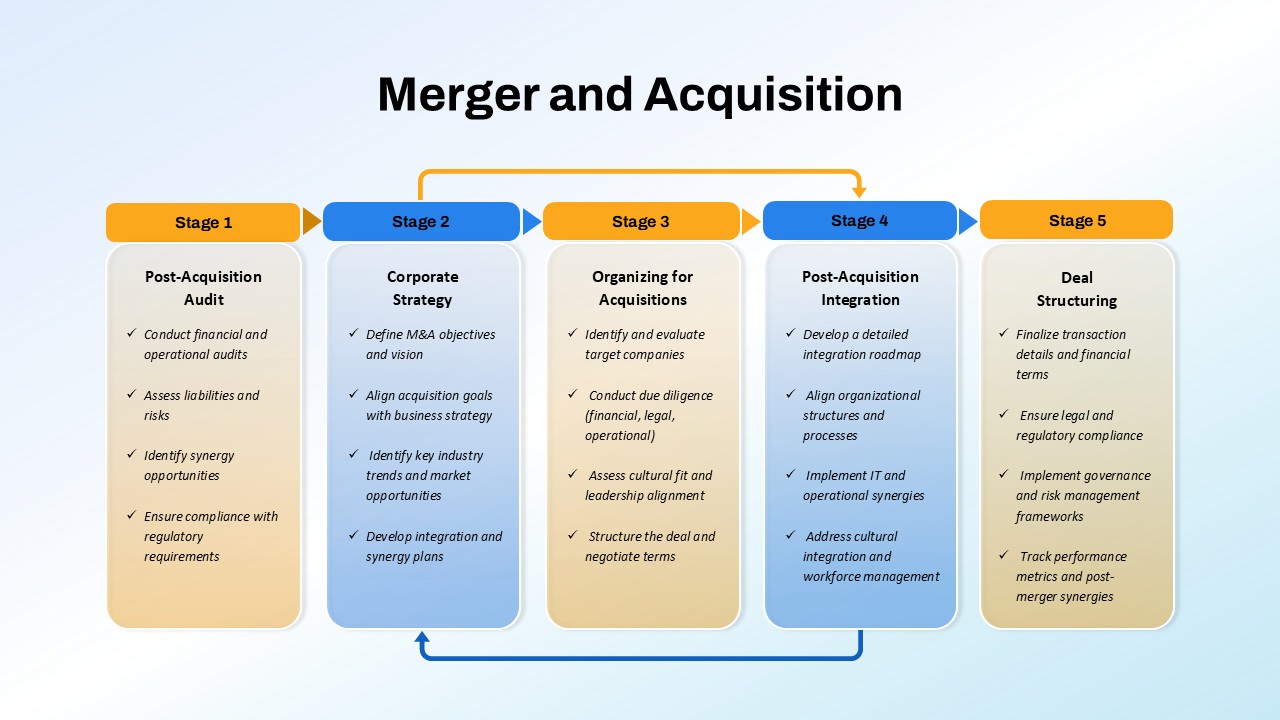

Simplify complex corporate transitions with this Merger and Acquisition Presentation Template, designed to clearly outline the key phases involved in successful M&A execution. Ideal for business consultants, corporate strategists, financial advisors, and executive leadership, this merger & acquisition ppt template breaks down the M&A lifecycle into five distinct and color-coded stages.

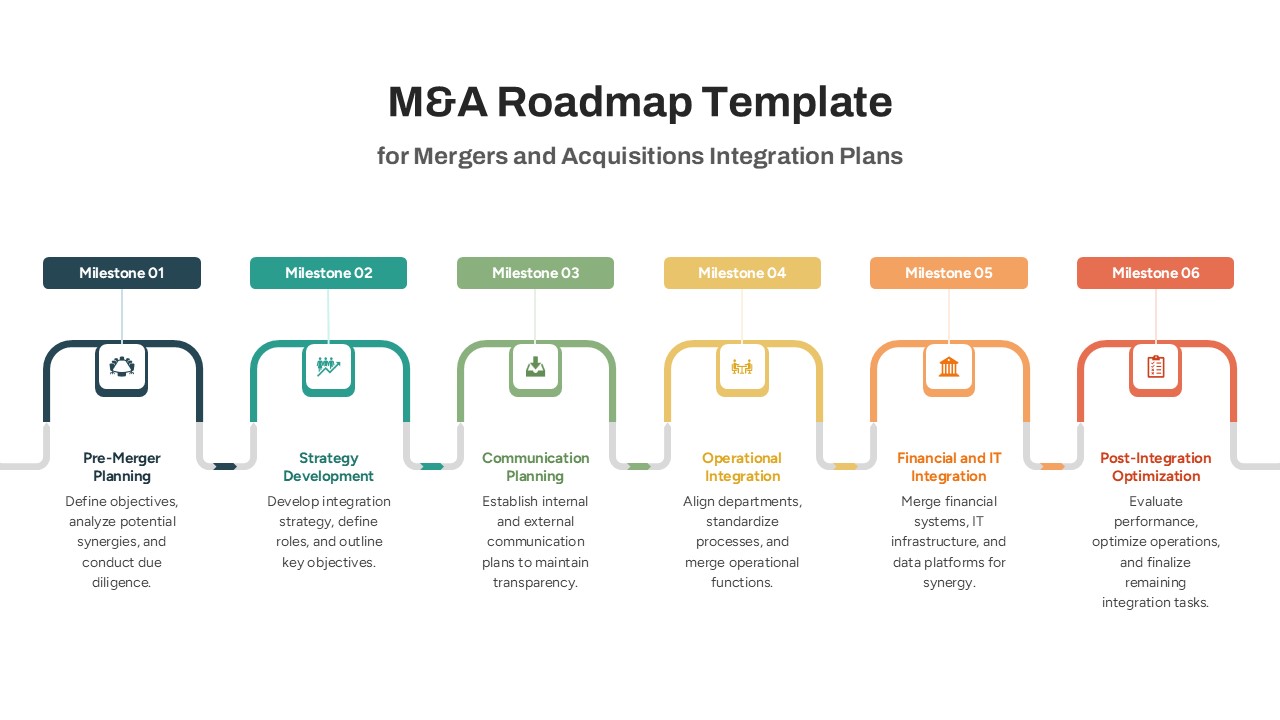

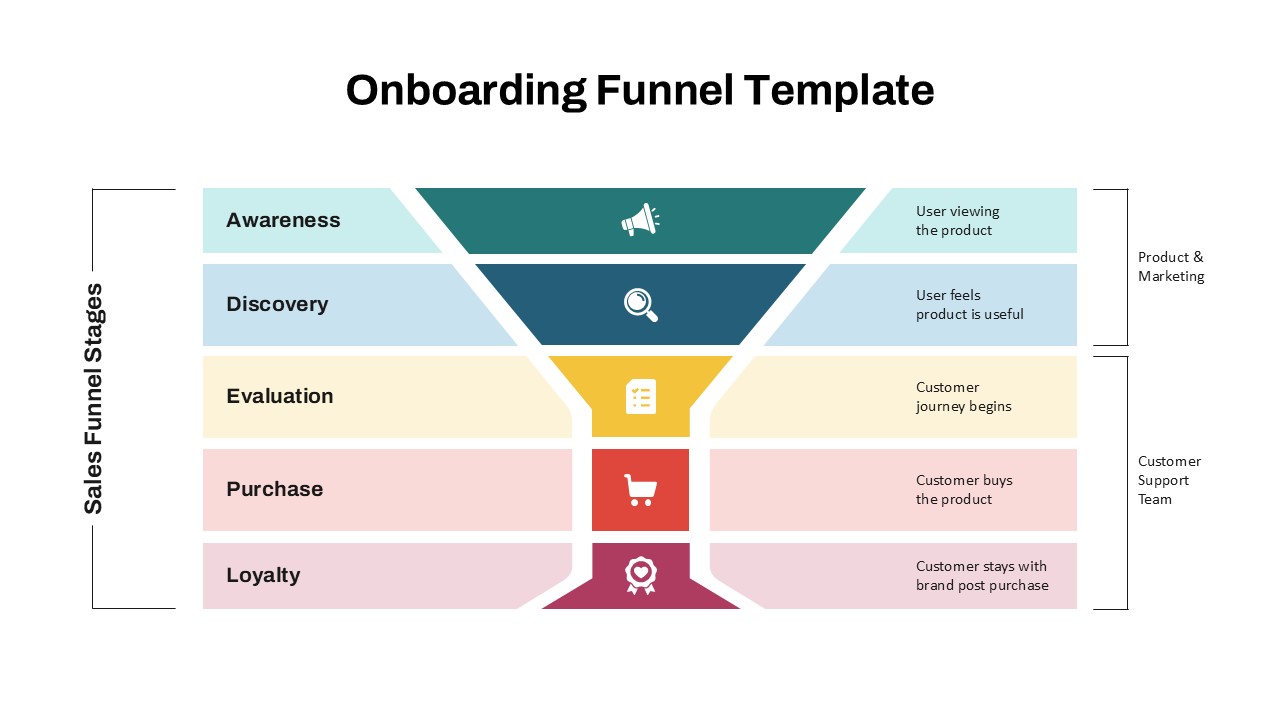

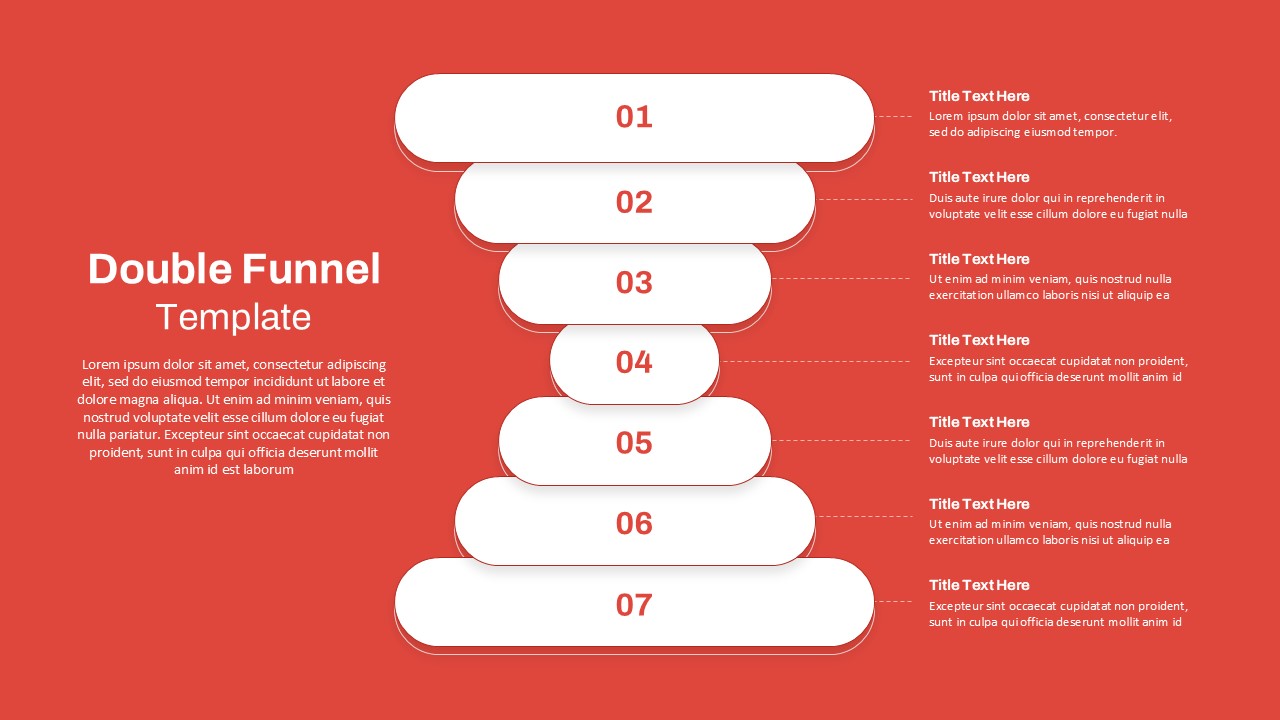

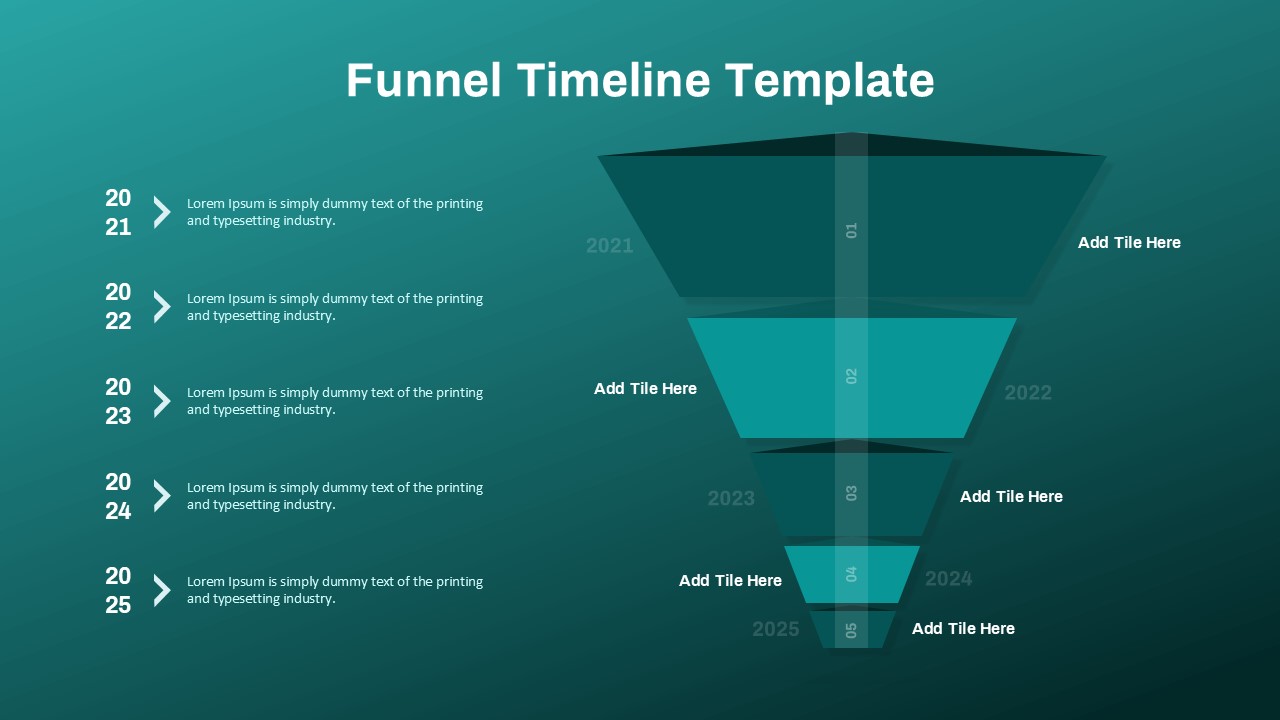

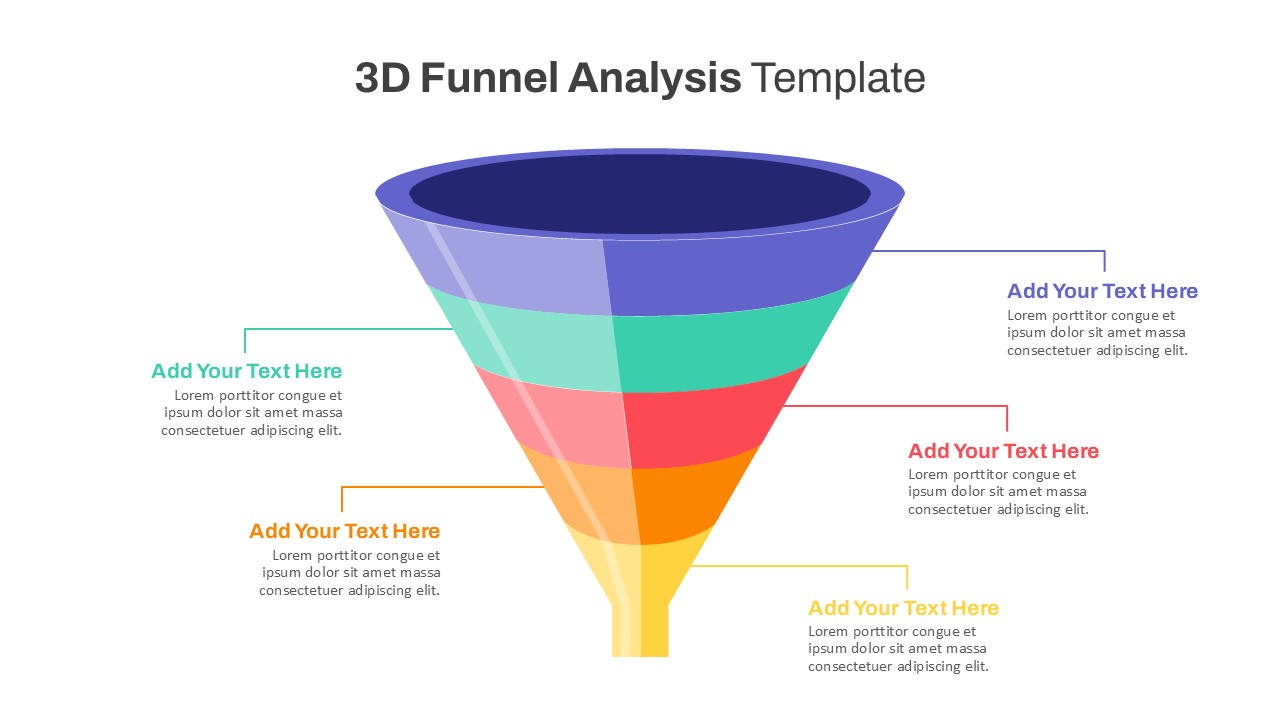

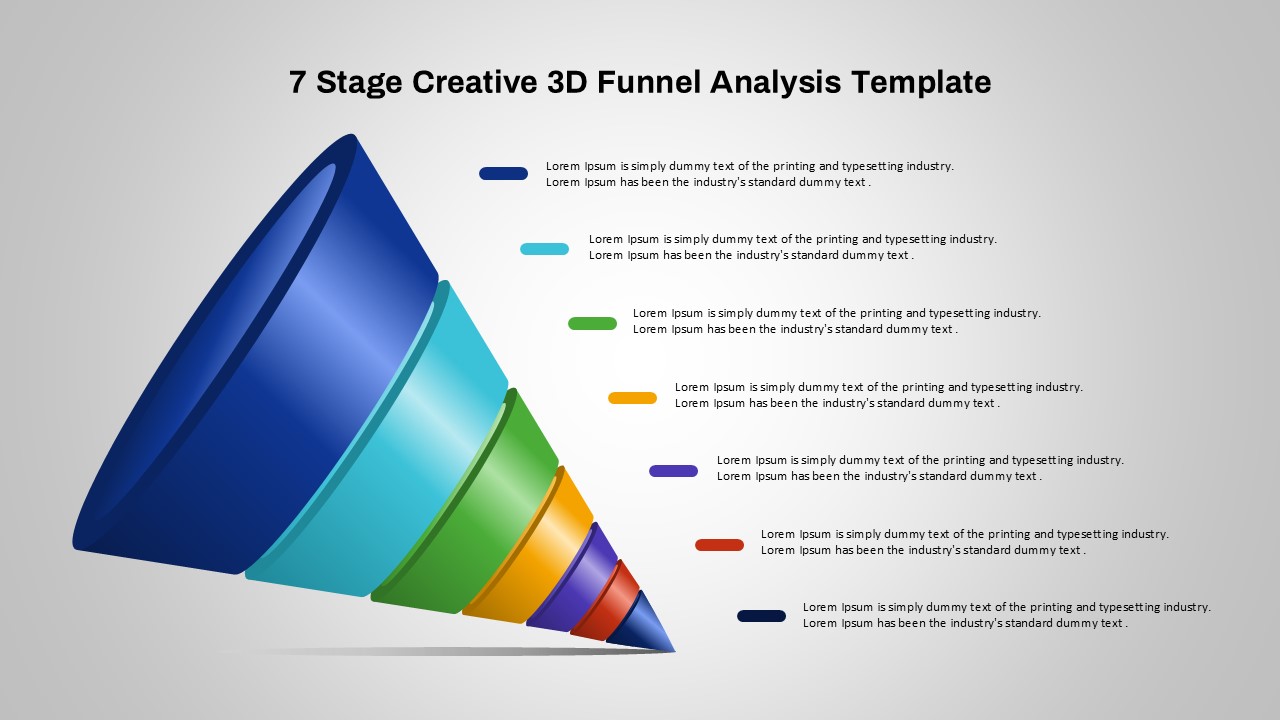

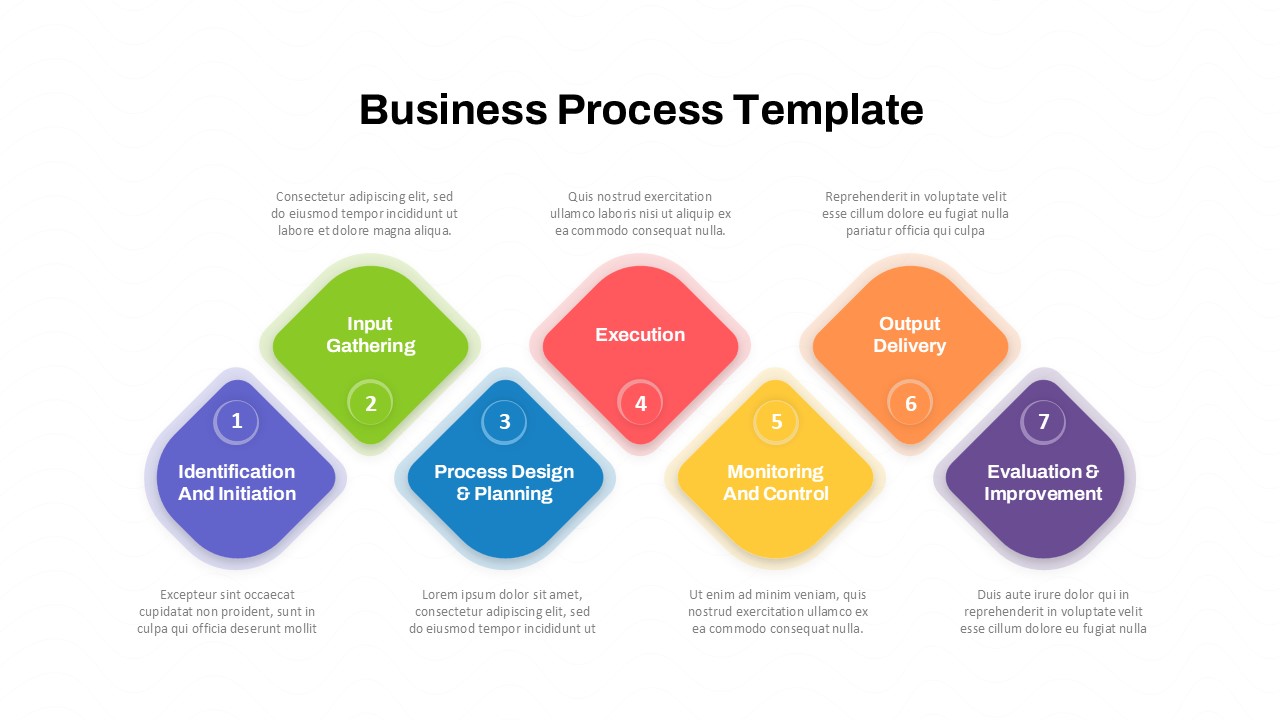

Each vertical segment represents a phase in the process:

- Stage 1: Post-Acquisition Audit – Focused on assessing financials, risks, and identifying synergy opportunities post-deal.

- Stage 2: Corporate Strategy – Defines M&A objectives, aligns acquisition goals with long-term vision, and explores market opportunities.

- Stage 3: Organizing for Acquisitions – Includes target evaluation, due diligence (financial, legal, operational), and negotiation strategy.

- Stage 4: Post-Acquisition Integration – Covers integration planning, IT and operational alignment, and workforce management.

- Stage 5: Deal Structuring – Finalizes the transaction with a focus on compliance, governance, and synergy tracking.

Directional arrows between stages visually guide the audience through the sequence while reinforcing the cyclical or iterative nature of M&A strategy development. Whether used for stakeholder briefings, board presentations, or internal planning, this template offers a structured view of the end-to-end M&A journey.

Fully editable in PowerPoint and Google Slides, it allows easy customization to fit specific industries or company scenarios—making it a practical asset for any organization exploring growth through acquisitions.

See more

Features of this template

Other User Cases of the Template

Corporate development planning, investor pitch decks, business restructuring presentations, post-merger integration reports, M&A consulting deliverables, due diligence workshops, financial advisory sessions, internal strategy meetings, executive M&A training, strategic growth roadmaps