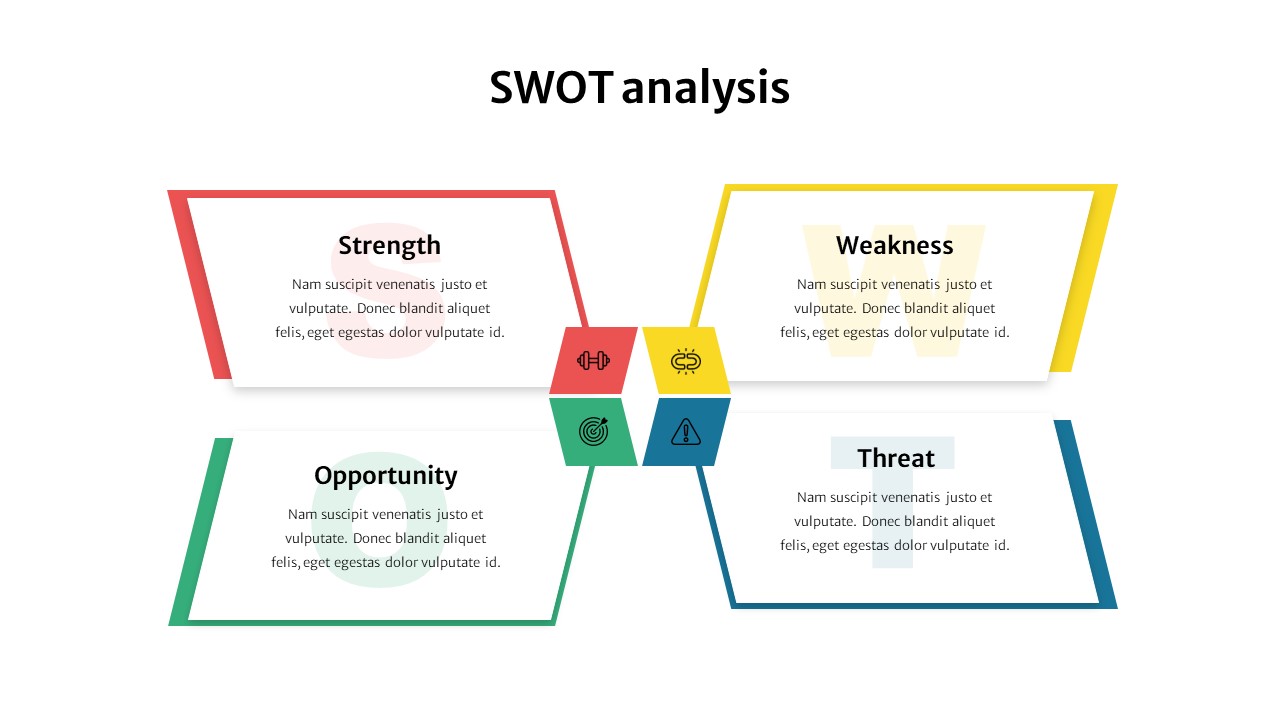

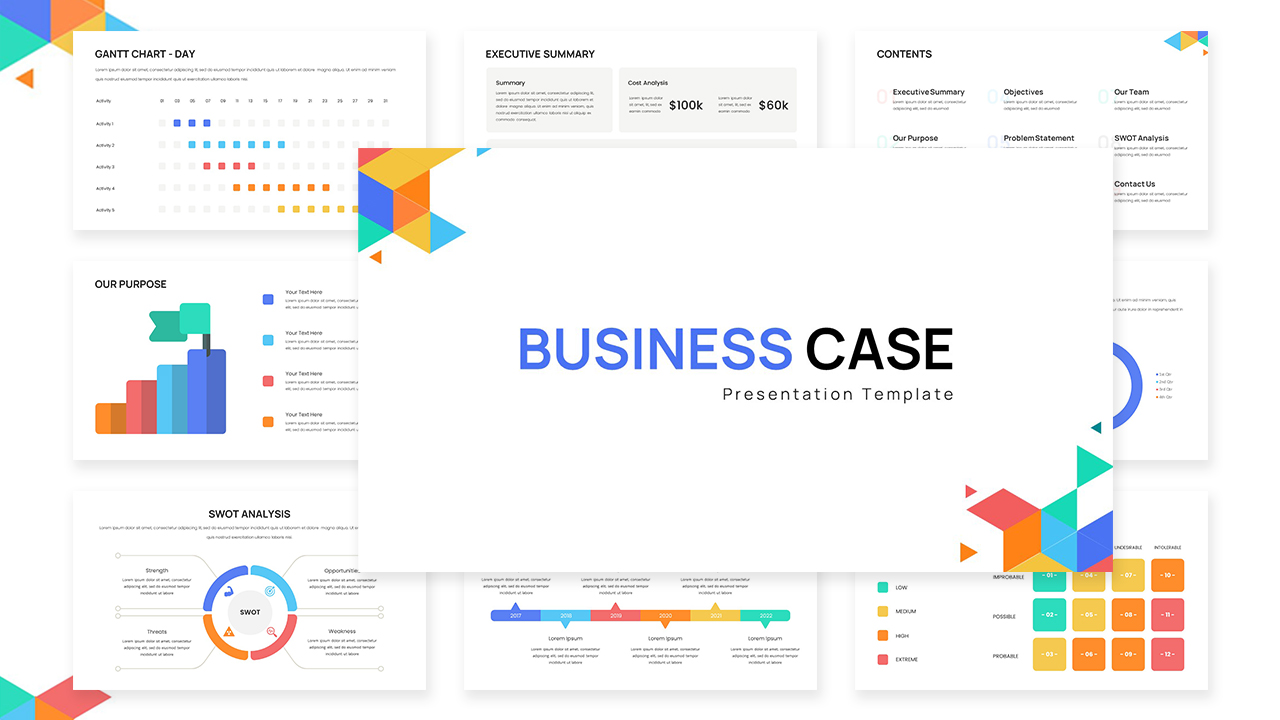

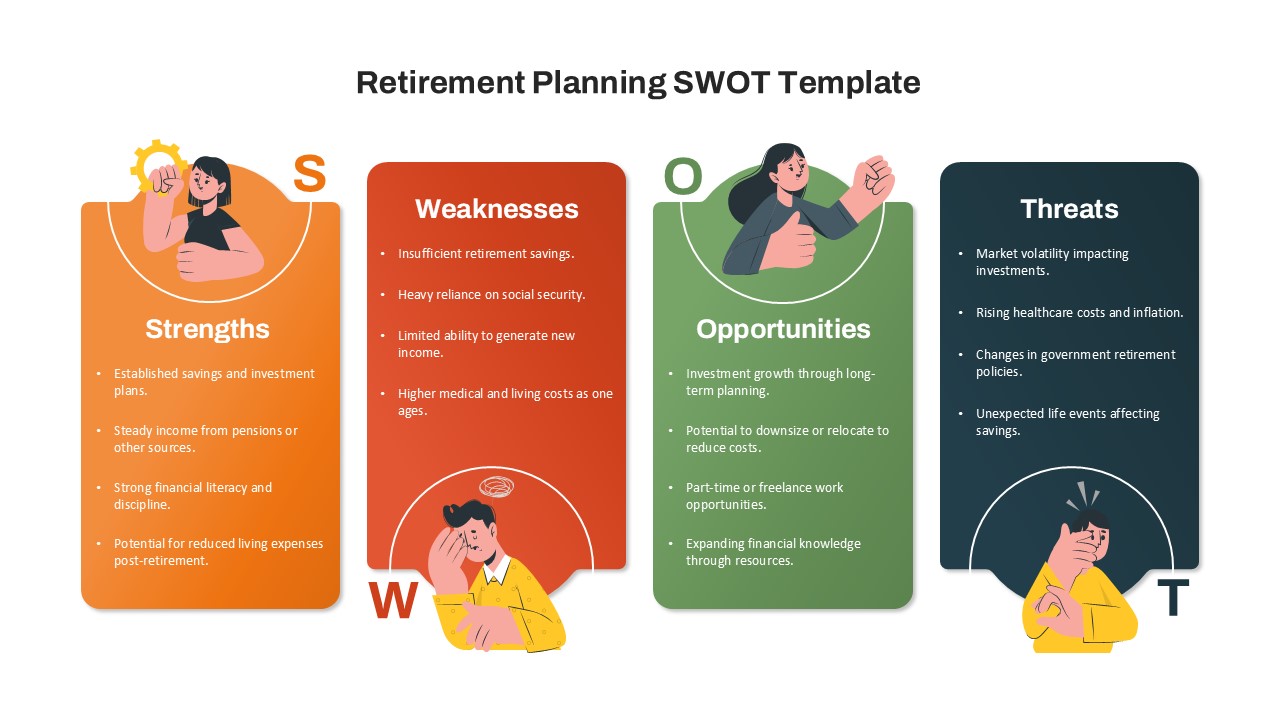

Retirement Planning SWOT Analysis Template

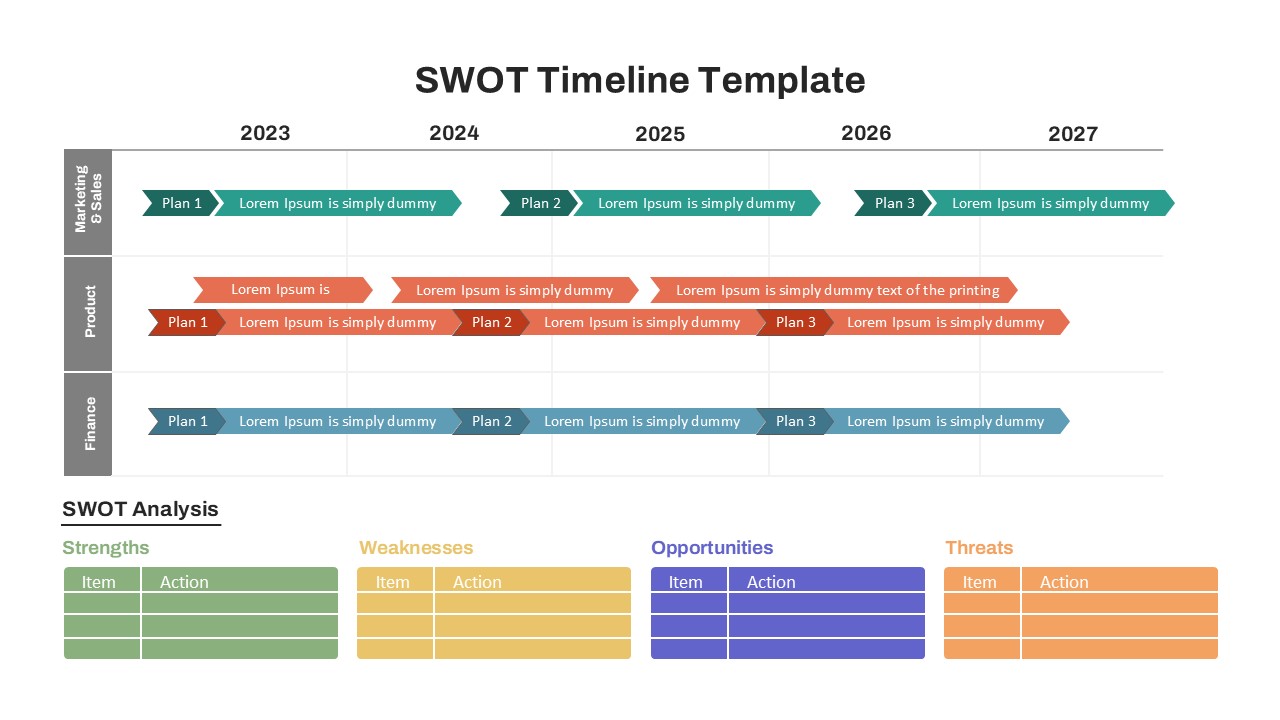

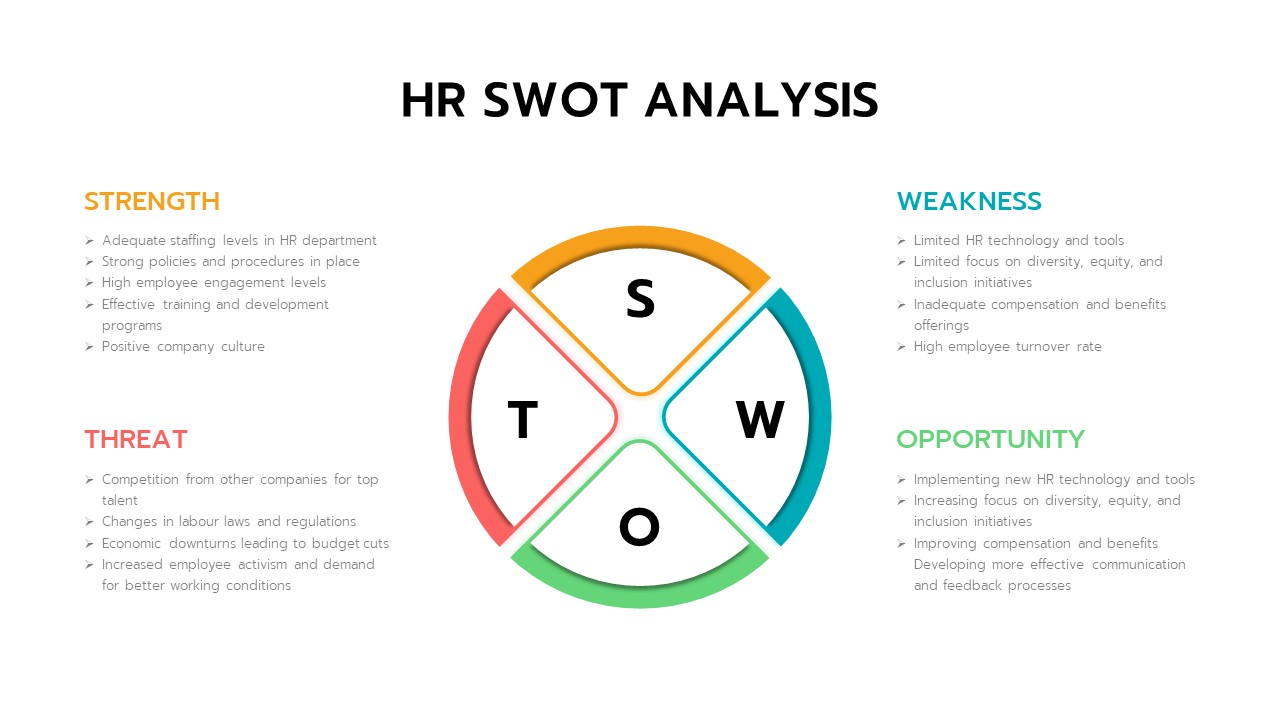

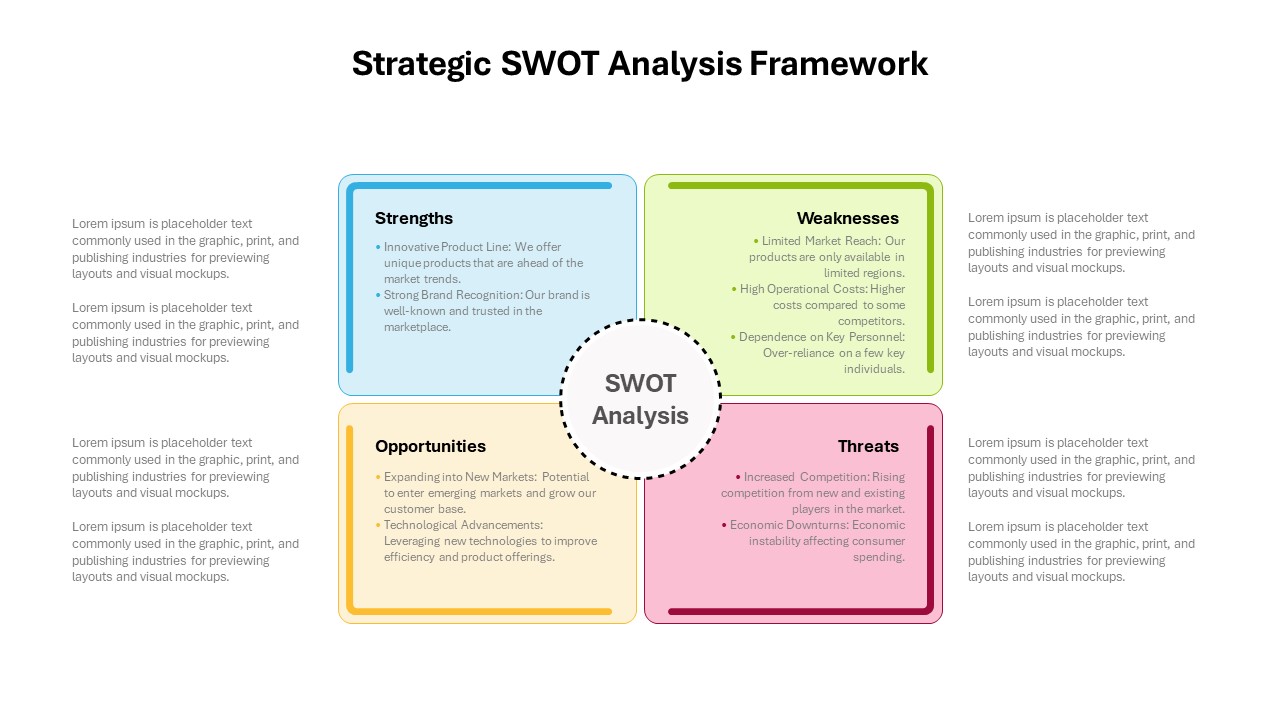

The Retirement Planning SWOT Analysis Template is a visually engaging and structured tool designed to assist individuals and financial advisors in assessing the critical factors involved in retirement planning. Using the traditional SWOT framework, this SWOT Analysis PPT template allows users to analyze the Strengths, Weaknesses, Opportunities, and Threats associated with their retirement plans, ensuring a comprehensive evaluation of financial security for the future.

Each section is organized with unique colors and accompanied by relatable illustrations, making complex financial topics more approachable and easier to understand. The Strengths section focuses on positive aspects like established savings, steady income sources, financial literacy, and potentially lower living expenses after retirement. The Weaknesses section, highlighted in contrasting red, addresses challenges such as insufficient savings, heavy reliance on social security, limited income generation capacity, and increased medical costs with age.

In the Opportunities section, users can explore potential growth areas, such as long-term investment benefits, relocation for cost reduction, and part-time work options to supplement retirement income. Finally, the Threats section tackles external risks like market volatility, rising healthcare costs, policy changes, and unforeseen life events that may impact savings.

This template is ideal for retirement planning presentations, financial advising sessions, or personal finance workshops. Fully customizable in PowerPoint and Google Slides, it allows users to adjust each quadrant to suit individual needs, making it a versatile tool for long-term financial security planning.

See more